- Solana (SOL) is attracting institutional investors despite a general market deceleration.

- Solana registered cumulative inflows of $14.1 million over nine weeks.

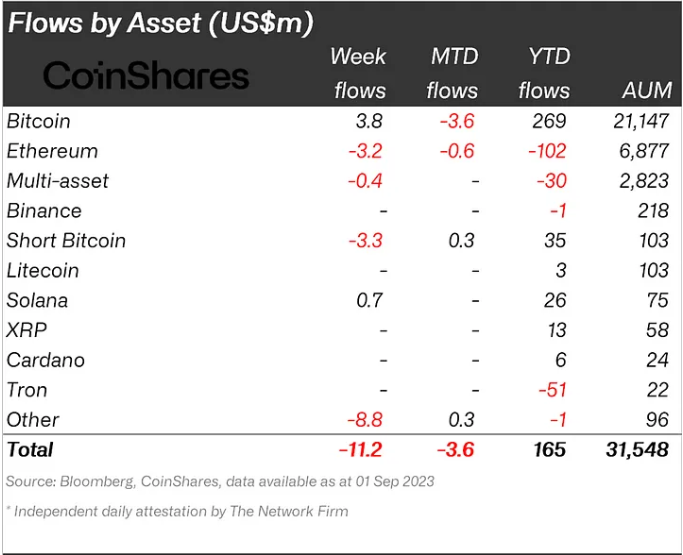

- Bitcoin recorded weekly inflows totaling $3.8 million, defying market sentiment.

During a week characterized by a declining enthusiasm for digital asset investments, Solana

Amid this de-escalation phase, digital asset investment vehicles witnessed relatively insignificant withdrawals of $11.2 million. This marks the seventh consecutive week of bearish sentiment, culminating in a total outflow of $342 million. It’s worth noting that Polygon and Ethereum experienced substantial outflows of $8.6 million and $3.2 million respectively.

Institutional Inflows Boost Solana (SOL)’s Performance

At present, Solana is taking center stage in the altcoin sector. CoinShares’ analysis indicates that even with notable crypto investors pulling out their investments from other altcoins, Solana consistently garners substantial institutional attention.

The previous week, SOL witnessed an investment influx of $700,000 via cryptocurrency investment platforms, solidifying its position as the current favorite altcoin among investors. This spike in investor interest has been duly noted, with Solana-based products recording weekly inflows of $700,000, marking the ninth successive week of such inflows. Throughout this nine-week timeframe, Solana registered cumulative inflows amounting to $14.1 million, contributing to the year-to-date inflows totaling $26 million.

As of the time of this report, Solana (SOL) is currently priced at $19.28, reflecting a 1.96% decline over the past 24 hours. However, SOL’s daily trading volume has experienced a significant increase, surging by more than 18% to hit $215 million.

Bitcoin

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.