- Bancor’s token BNT has rallied over 50% due to increased trading volume.

- A potential phishing attack on the Carbon DeFi protocol was disclosed.

- Bancor’s active addresses increased significantly, sparking future growth speculations.

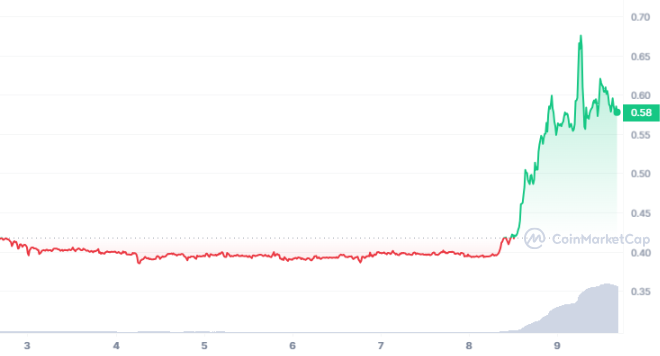

In response to the increase in trading volume, Bancor’s proprietary token BNT has initiated a significant rally within a parabolic pattern. The value of BNT has escalated by over 50% during this pattern, moving from its 24-hour low of $0.4603 to a peak of $0.6906.

According to data from CoinMarketCap, Bancor has seen a nearly 2,500% surge in its trading volume, coinciding with its recent rise. There is ongoing debate among investors about the sustainability of Bancor’s current growth rate, given its current dominance in the altcoin market. As of the time of this report, Bancor’s token

Proactive stance

A potential phishing attack, which could have disrupted the Carbon DeFi protocol ecosystem, was disclosed on the protocol’s official social media platform. The protocol’s primary development plan and this preemptive action have boosted trust in the ecosystem, distinguishing it from other recently compromised protocols.

Another impressive statistic was observed: 797 distinct BNT addresses were active daily. This and its recent price increase have ignited discussions about Bancor’s future among cryptocurrency enthusiasts and specialists. The significant increase in active addresses has also contributed to these speculations.

Bancor has long been a leading player in the DeFi sector, operating as a decentralized liquidity protocol on the Ethereum blockchain. Its innovative liquidity provision approach and automated market maker (AMM) system have made it a preferred choice for traders and investors who prioritize efficiency and decentralization.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.