- Worldcoin (WLD) market shows strong bearish momentum, with prices dropping significantly.

- Technical analysis suggests a potential recovery in the WLD market.

- The Relative Strength Index indicates a neutral to slightly bullish market.

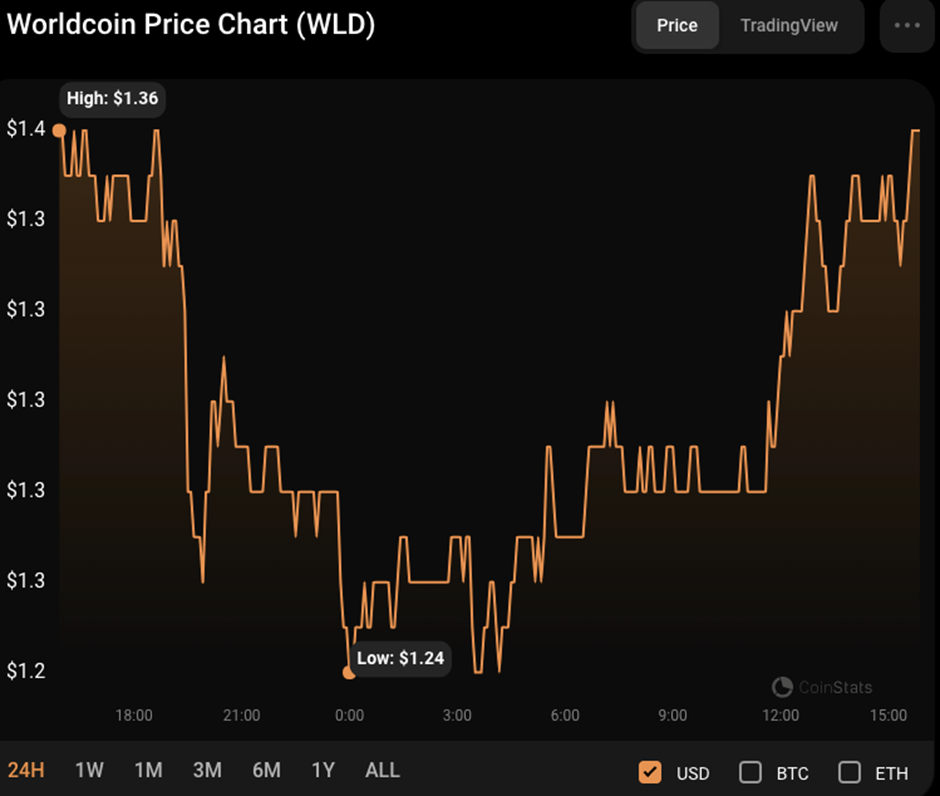

Over the last 24 hours, the Worldcoin

If the value drops below $1.24, bearish traders will drive the market towards the next support level at approximately $1.20. Conversely, if bullish traders can counteract the negative momentum, WLD has the potential to rebound and regain its strength.

The market capitalization and 24-hour trading volume of WLD experienced a decrease of 1.38% and 44.55%, respectively, bringing them down to $174,797,988 and $124,436,135. This downward shift in market capitalization and trading volume indicates a negative trend in the WLD market.

The Fisher Transform has moved beyond its signal line, registering a value of -1.06, suggesting that the WLD market is currently oversold and could be on the brink of a reversal. This shift in the Fisher Transform could mean that the selling pressure on WLD has potentially reached its peak. Market participants, including traders and investors, might interpret this as an opportunity to buy at reduced prices, possibly triggering a market recovery.

Furthermore, the increasing rate-of-change (ROC) score of -1.90 suggests a potential recovery in the WLD market. This shift indicates a decrease in the downward trend, hinting at a possible upward movement. Should the ROC ascend into the positive range, it could validate the potential for a market rebound.

Additionally, the technical analysis suggests a robust buy signal, implying that the downward trend could cease. This graph supports the idea of a potential recovery in the WLD market as it demonstrates substantial buying pressure and trader confidence, which could result in a market upswing. A positive rate of change coupled with a ‘strong buy’ signal increases the likelihood of a market rebound.

Furthermore, a Relative Strength Index (RSI) reading of 56.95 aligns with a neutral to slightly bullish market. Although it’s less strong than the technical indicators, there’s still potential for the WLD market to increase. If the RSI surpasses its signal line, it suggests a stronger bullish sentiment and supports the possibility of a market recovery.

To sum up, despite the bearish trends that the Worldcoin (WLD) market has experienced, there are encouraging indications of a potential recovery. Given the oversold status, decreasing negative momentum, and robust purchase signals, WLD could be on the verge of a bounce back.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.