According to a recent report by Reuters, Tether, a digital stablecoin, is gaining popularity as the most secure asset in the volatile cryptocurrency world. With the ongoing banking crisis in the United States and heightened regulatory scrutiny on crypto companies, investors focus on tokens and coins that offer greater security. Tether’s reputation as a stable and reliable asset makes it a top choice for those seeking stability in the unpredictable crypto market.

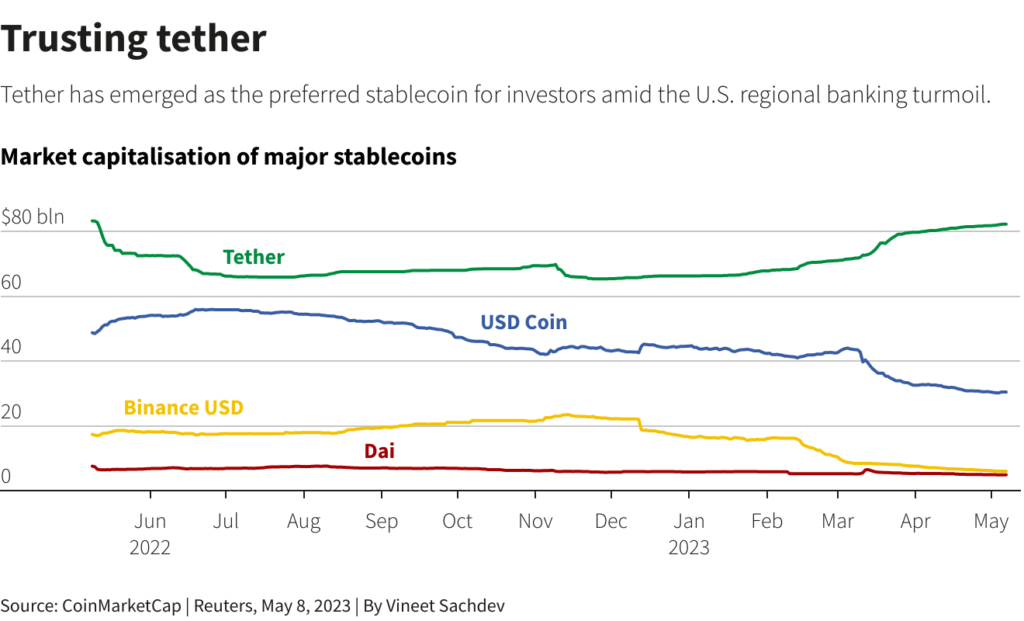

Since March, Tether, a stablecoin pegged to a fiat currency like the US dollar, has emerged as the top-performing stablecoin, experiencing a substantial surge in market value.

A robust reserve of US dollars fortifies Tether’s value and boasts a finite supply of roughly 85 billion tokens, ensuring a steadfast 1-to-1 correlation with the US dollar. The coin’s unwavering value has persisted above 1 since mid-April, with a recent peak of 1.002, a testament to its soaring popularity.

According to the esteemed founder of AKJ global brokerage, Anders Kvamme Jensen, who is based in the bustling city of Oslo, it is imperative to note that…

The banking crisis is fuelling ‘hyper-bitcoinisation’ – the inevitable endgame that the dollar will be worthless.

According to Jensen, a notable influx of investors has been gravitating towards top-tier cryptocurrencies, namely Bitcoin and Ether.

Stablecoins like Tether have emerged as a reliable store of value and a versatile instrument for facilitating seamless transfers between cryptocurrencies. Additionally, they serve as a valuable form of collateral for derivative trades. The premium price of Tether can be attributed to the increasing confidence in its peg and its immunity to regulatory scrutiny from the SEC.

In recent times, USDC, a rival of Tether, has faced setbacks due to its association with a failed bank and the mounting regulatory scrutiny on fintech and cryptocurrency enterprises. On the other hand, under the ownership of iFinex Inc, Tether is perceived as having a more global outlook, thereby mitigating regulatory risks.

Furthermore, it has ascended to the esteemed position of the third-largest token on CoinMarketCap, boasting an impressive market capitalization of $82 billion and a substantial share of 6.83%.