- Shiba Inu (SHIB) has experienced a 90.16% drop from its ATH.

- SHIB’s recent performance has resulted in a correlation of 0.86 with Bitcoin (BTC).

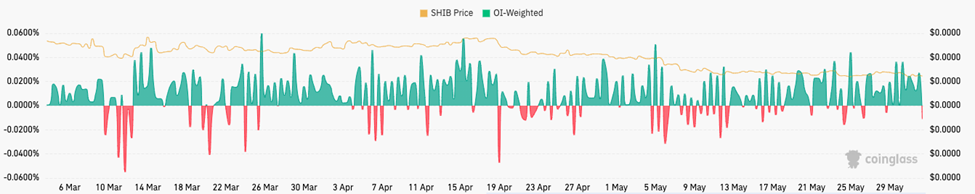

- The funding rate for SHIB has taken a negative turn.

According to data from IntoTheBlock, Shiba Inu (SHIB) has experienced a staggering 90.16% drop from its All-Time High (ATH), resulting in 81% of its holders currently in a state of loss. This unfortunate circumstance shows the token’s inability to keep pace with other cryptocurrencies during brief market surges.

As per the analysis conducted by the crypto market insight platform, SHIB’s recent performance has resulted in a correlation of 0.86 with Bitcoin (BTC). While this correlation is undoubtedly strong, it also indicates that the meme coin has not been entirely aligned with BTC’s movements in recent times.

Nonetheless, the potential absence of returns for SHIB’s committed investors may only partially stem from low market demand and limited trading activity.

SHIB’s bearish nature continues to linger

Furthermore, the advent of Pepecoin (PEPE) has also been a contributing factor. Despite the decline in token worth, the wider cryptocurrency community has kept a watchful eye on it.

According to LunarCrush, there has been a noteworthy surge in social engagement for SHIB in the past week, indicating a rise in interest and conversation surrounding the asset. However, the question remains: when will SHIB break free from its lackluster performance?

According to the daily chart depicted above, SHIB has struggled to maintain significant resistance. On 19 April, the psychological resistance 0.00001549 experienced a sharp decline, and all subsequent efforts to regain it have proven fruitless.

Furthermore, the 20-day Exponential Moving Average (EMA) intersects with the 50-day EMA (orange), indicating that sellers currently dominate the market. As a result, the prospects of SHIB making a swift recovery are challenging.

On 9 March, a promising development occurred in SHIB trading. The 200-day EMA (colored in a regal purple) gracefully crossed above the 20 and 50 EMAs, creating a golden cross. This auspicious event suggests that SHIB may be on the cusp of a new uptrend in the mid to long-term. Such a situation warrants attention and careful consideration for those invested in the cryptocurrency market.

The On-Balance-Volume (OBV) – a metric that gauges the buying and selling pressure – has remained relatively stagnant. The OBV indicates that the market participants’ inclination towards purchasing or selling the token has shifted.

Shorts’ time to reign in the market

According to Coinglass, the funding rate for SHIB has taken a negative turn, indicating that traders taking short positions are now willing to pay the funding fees of those holding long positions to maintain their futures contracts.

Conversely, a positive funding rate indicates a bullish sentiment among traders, prompting those with long positions to pay shorts. This dynamic reflects the willingness of traders to take on risks and capitalize on potential gains.

Over time, there is potential for SHIB to experience a resurgence, given its status as a favored token among whales. Nevertheless, in the near term, bearish sentiments may persist.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.