- Bitcoin’s recent surge positively impacted other cryptocurrencies, including Pepe (PEPE).

- A ‘whale’ investor’s significant accumulation activity boosted PEPE’s price by 11.38%.

- PEPE’s bullish trajectory could pause if On-Balance-Volume remains in bearish zone.

The recent uptick in Bitcoin

However, that wasn’t the entirety of the story. Before PEPE’s surge to a peak of $0.000001246, on-chain analyst Lookonchain identified significant accumulation activity by a large-scale investor, often called a ‘whale’ in the crypto industry. As per Lookonchain’s report, this particular whale exchanged one million units of Circle

PEPE Attempts Another Ascending Shift

Generally, when a high-net-worth investor, often referred to as a ‘whale’ in the crypto industry, opts to purchase a substantial volume of a particular cryptocurrency, it drives up the asset’s price. This significant move can trigger a domino effect, influencing other market players to adopt a similar investment strategy.

Intriguingly, the 4-hour chart of PEPE against the USD corroborates this perspective. As of the latest update, a series of bullish candles have emerged following PEPE’s establishment of support at $0.0000011. Market participants have continued to drive the price higher, even with a slight pullback to approximately $0.00000122.

Before August 5, PEPE was entrenched in a bearish market trend. However, the Relative Strength Index (RSI) surge to 63.62 bolstered the notion of a robust bullish momentum. In the period from August 1 to 7, the RSI failed to approach the 50 mid-point, signifying the dominance of sellers in dictating PEPE’s momentum.

The recent upward trend of the indicator has effectively counterbalanced the selling pressure, positioning PEPE for a potential 20% surge.

Nonetheless, for the meme coin to experience a significant surge beyond its current level, it would require the backing of the On-Balance-Volume (OBV). As of this writing, the OBV stands at a negative 744.69 billion. Despite the uptick in the OBV, its persistence in the negative territory suggests potential distribution activity.

Is the objective $0.0000014?

Should the OBV persist in the bearish zone, PEPE’s bullish trajectory could potentially hit a pause, resulting in a negative divergence. However, if the OBV successfully transitions into the bullish zone, it would validate heightened accumulation activity.

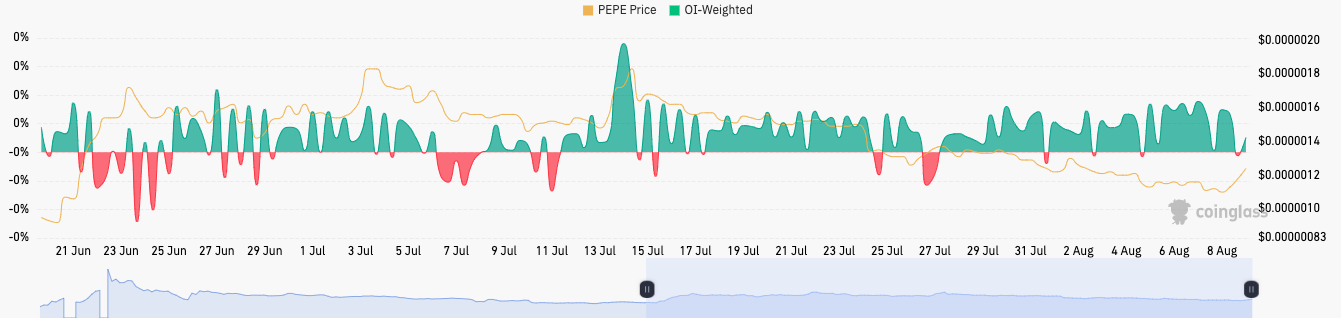

Contrary to the On-Balance-Volume (OBV) signals, market participants maintained a bullish stance on PEPE, driven by the funding rate. At the time of writing, the funding rate stood at 0.0052%. A positive funding rate typically signifies a prevailing bullish sentiment in the broader market.

However, a negative sentiment indicates traders are pessimistic about the price movement. The funding rate revealed that the average trader’s target was $0.0000014. Yet, PEPE would necessitate an increase in buying pressure to attain this price.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.