- Ripple (XRP) and Stellar (XLM) experience substantial growth amidst Bitcoin’s halt.

- XRP surges by 69.74% in 24 hours due to legal victory against SEC.

- Increasing adoption of Stellar’s Anchor Network leads to significant surge in XLM.

Altcoins such as Ripple (XRP) and Stellar (XLM) have experienced substantial growth amidst a temporary halt in Bitcoin’s (BTC) upward trend. As per CoinMarketCap data, XRP has surged by an impressive 69.74% within the past 24 hours.

BTC lags behind due to recent advancements

The recent surge in price can be attributed to Ripple’s recent legal victory against the SEC. According to data from a prominent price tracking platform, XLM has demonstrated exceptional performance, as evidenced by a remarkable 30-day increase of 109.57%.

The significant surge in the altcoin can be attributed to the increasing adoption of its Anchor Network, which is the crucial link between the Stellar network and conventional financial institutions. To provide context, the Anchor Network of Stellar Lumens facilitates seamless onboarding and offboarding processes, enabling a smooth transition between the Stellar network and traditional finance.

Bitcoin, which has exhibited a remarkable Year-To-Date (YTD) performance, has experienced a moderation in its upward trajectory. As of the present moment, BTC is being traded at $30,120. Furthermore, TradingView data indicates that Bitcoin’s market dominance, previously exceeding 52% a few weeks ago, has now receded to 49.90%.

The decline in BTC dominance has sparked speculation among market participants regarding the potential emergence of an altcoin season. This hypothesis holds merit as historical data indicates that a decrease in BTC dominance typically coincides with a surge in altcoin prices.

XRP Targets $0.90

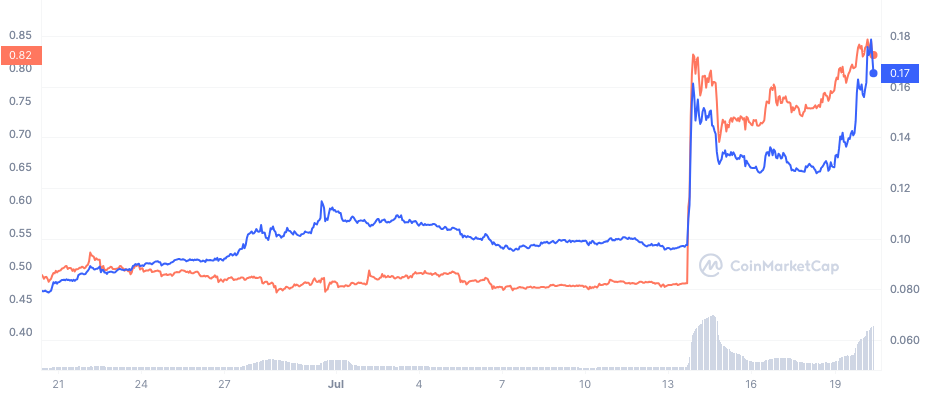

The 4-hour chart for XRP/USD indicates a significant surge in demand for XRP after it broke out of consolidation on July 13. Despite a slight increase in selling pressure the following day, XRP managed to maintain its upward momentum as buying pressure resumed at the $0.68 level.

Furthermore, the Money Flow Index (MFI) indicates a substantial influx of liquidity into the XRP market. Currently, XRP’s MFI stands at 70.98, which suggests it has yet to reach the overbought level of 80. Consequently, it is unlikely that there will be a significant shift in the trend shortly, and there is a potential for XRP to surpass the $0.90 threshold.

XLM aims for the top but retreats

It is worth noting that the XLM/USD 4-chart exhibited a comparable pattern to XRP, albeit with a distinguishing factor. Unlike XRP, XLM had reached an overbought level, indicating a potential market condition where the asset’s price may have exceeded its intrinsic value.

The Bollinger Bands (BB) further substantiated this deduction as the upper band of the BB made contact with XLM at $0.168, indicating heightened volatility. Such an occurrence typically suggests that the asset is experiencing overbought conditions.

Furthermore, the Relative Strength Index (RSI) registered a value of 73.27, suggesting that XLM was exhibiting signs of being overbought. The BB and RSI indicators further confirmed this. Consequently, it is plausible to anticipate a potential retracement in the XLM price, possibly towards the vicinity of $0.151. However, it is worth noting that the Chaikin Money Flow (CMF) displayed a positive reading of 0.06, indicating a favorable influx of capital into XLM.

Based on the CMF reading, it is evident that XLM’s buying power remains strong. Therefore, in the event of a price correction, it is expected to experience a temporary pause before resuming its upward momentum as long as the CMF indicator remains above the zero level.

To summarize, the recent performance of XRP and XLM indicates a notable surge in the dominance of altcoins vis-à-vis Bitcoin.

Additionally, CoinMarketCap has unveiled that alternative cryptocurrencies such as Polygon (MATIC) and Chainlink (LINK) have exhibited superior performance compared to Bitcoin. This development suggests that the altcoin season may be imminent.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.