- Influential market participants anticipate Bitcoin to reach $30K to $31K.

- Prominent crypto investors have accumulated stablecoins Dai and Paxos Standard.

- Bitcoin’s price fluctuations exhibit striking similarities and potential retracement levels.

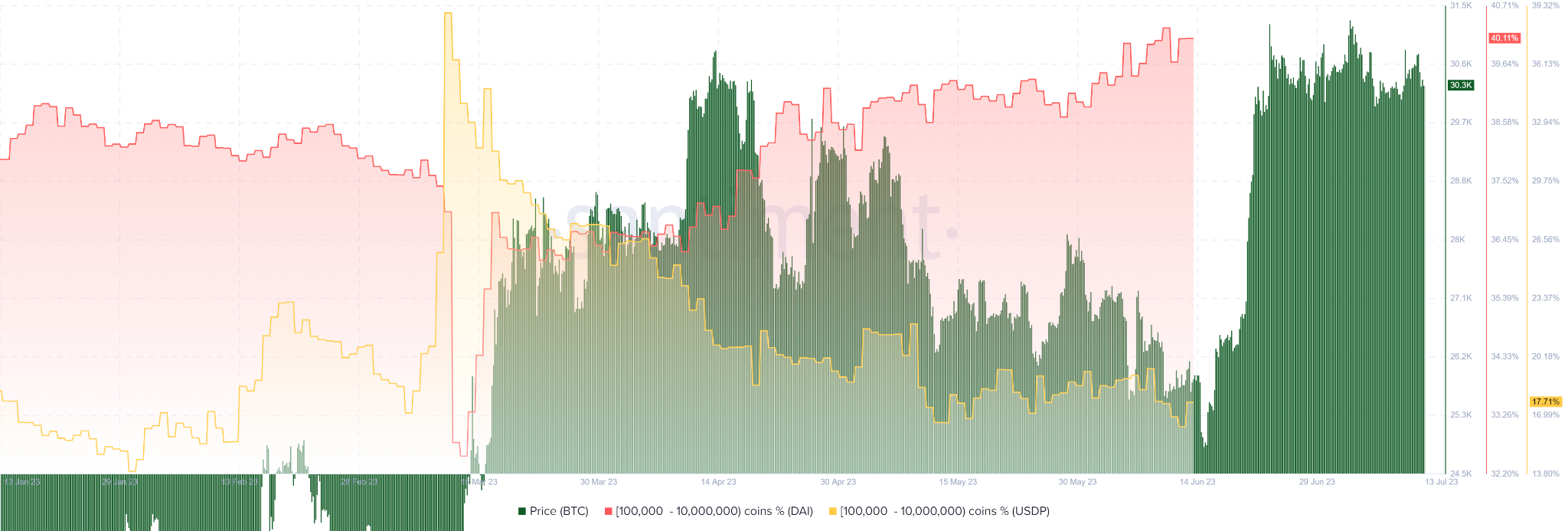

According to Santiment, a prominent market intelligence platform specializing in cryptocurrencies, there is notable anticipation among influential market participants, commonly called sharks and whales, for Bitcoin (BTC) to reach the price range of 30K to 31K. These significant players are eagerly awaiting this price level to execute a substantial purchase of cryptocurrencies. In their strategic preparations for this significant acquisition, these whales actively accumulate stablecoins such as Dai ($DAI) and Paxos Standard ($USDP).

Providing enhanced quantitative analysis, Santiment has reported that prominent crypto investors have amassed 2% of the total DAI supply since June 27 and 11% of the overall USDP supply since July 2.

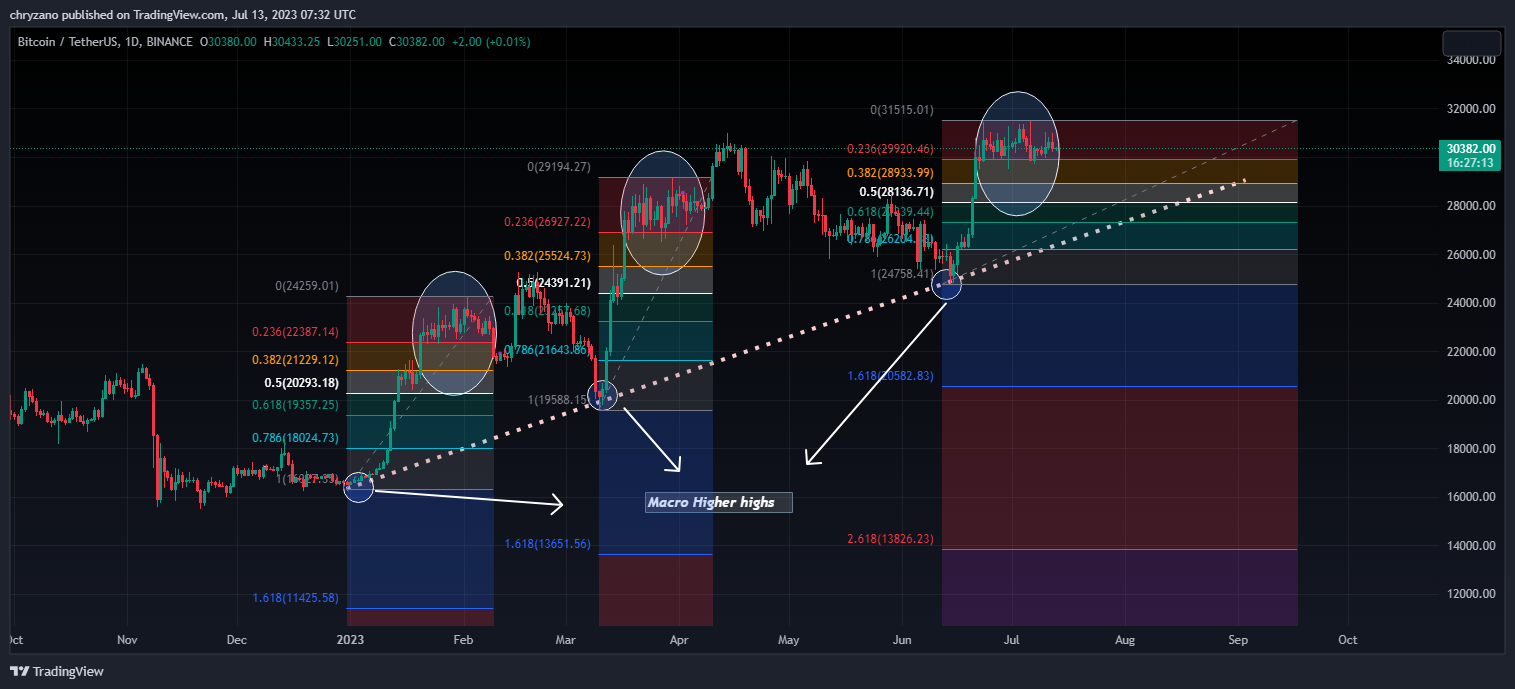

At this pivotal juncture, the US Dollar’s diminishing value has created an opportune moment for other markets, such as stocks and cryptocurrencies, to gain value potentially. Notably, Bitcoin (BTC) has reached the desired target anticipated by influential players in the industry. Currently, BTC is being traded at $30,382, reflecting a 1.34% decline over the past 24 hours.

As depicted in the chart, the observed patterns of BTC’s price fluctuations exhibit striking similarities. BTC demonstrated a consolidation phase above the 0.236 Fibonacci retracement level in all three instances. Notably, each consolidation period followed a significant price spike. Additionally, it is worth mentioning that every subsequent higher low formed by BTC during 2023 occurred precisely at the Fib retracement 1 level.

Given that BTC has formed a hammer pattern and is presently undergoing a test of the 0.236 Fibonacci retracement level, buyers will likely be able to uphold this level. Nevertheless, if BTC surpasses the 0.236 Fibonacci retracement level, there is a significant likelihood of it oscillating within the range of 0.236 and 0.382 Fibonacci retracement levels, corresponding to $29,900 and $31,500, respectively (potential retracement levels).

In the current market scenario, the whales are poised to capitalize on the recent achievement of Bitcoin (BTC), hitting its highly anticipated target. The forthcoming journey of BTC towards new resistance levels is indeed intriguing. The initial breakthrough of $31,500 appears imminent, potentially paving the way for a subsequent ascent towards $41,000, where formidable resistance may be encountered.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.