Binance, the leading crypto exchange, has again demonstrated its dominance in the crypto spot market. For an impressive four months in a row, Binance has outperformed its competitors, maintaining a steady increase in market share. The latest report from CryptoCompare, a reputable market research firm, reveals that Binance’s market share has risen from 59.4% in January to an impressive 61.8% in February. This remarkable achievement is a testament to Binance’s unwavering commitment to providing top-notch services to its clients.

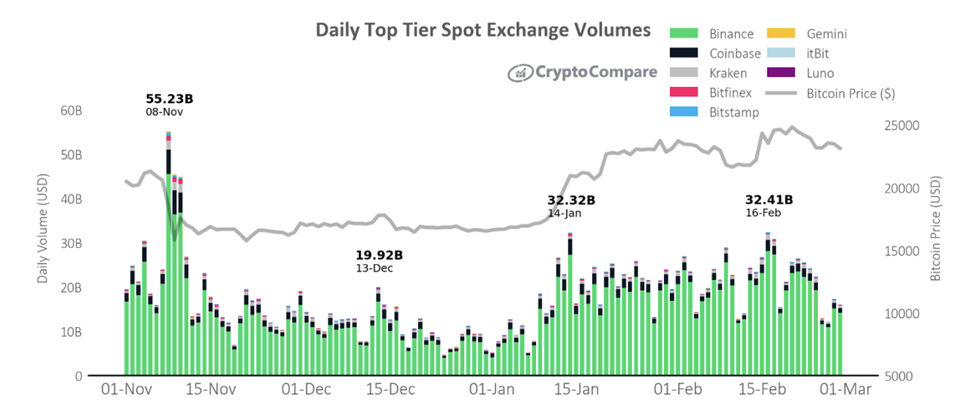

According to CryptoCompare, Binance has achieved an impressive 13.7% increase in spot volumes, reaching a record-breaking $504 billion. This is particularly noteworthy given the regulatory challenges and community concerns about the exchange. Furthermore, Binance has outperformed other top-tier crypto exchanges, including Coinbase and Kraken, by a significant margin in the crypto spot market.

According to Jacob Joseph, a seasoned research analyst at CryptoCompare, Binance’s supremacy in the market can be attributed to its impressive liquidity levels. Joseph further elaborated on this point, highlighting the exchange’s ability to facilitate large trade volumes easily.

Despite the recent criticism the exchange has received, market participants continue to take shelter on Binance under the premise that the largest exchange is seen as one of the safer trading venues.

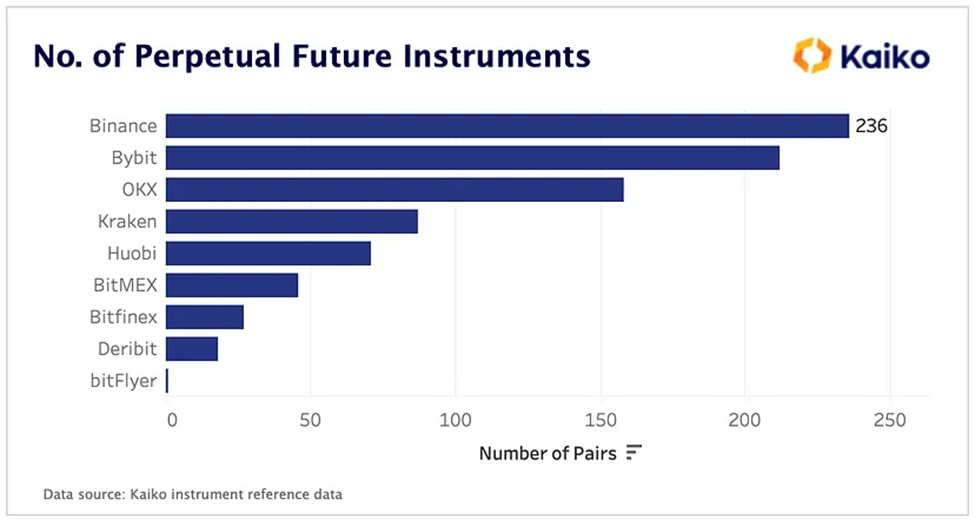

Binance has emerged as the undisputed champion of the crypto derivative market. As per a recent report by an institutional-grade market tracker, the exchange has surpassed FTX to become the market leader in the perpetual futures arena, boasting the highest number of pairs on offer.

Unfortunately, the FTX exchange, once a pioneer in derivative contracts, met its demise last November. However, Binance has now taken the lead with an impressive 236 listed pairs. While Bybit and OKX are closely competing with Binance, other exchanges such as Kraken, Huobi, and BitMex must catch up with more than 100 perpetual futures instruments on offer.

Over the past 24 hours, Binance has impressively surpassed a trading volume of $15 billion, leaving its closest competitor behind with a mere $4.1 billion in 24-hour trading volume. This remarkable achievement solidifies Binance’s position as a leading exchange in the industry.