- $25 million worth of Ethereum positions liquidated in past day.

- ETH’s value increases by 5%, reaching $1,814.

- Possibility of ETH reverting to a bearish state remains.

According to reports, a staggering $25 million worth of Ethereum (ETH) positions have been liquidated in the past day. Interestingly, it was discovered that most of these losses were incurred by traders who had taken short positions, as revealed by Coinglass. This is a stark reminder of the volatility and risks associated with cryptocurrency trading.

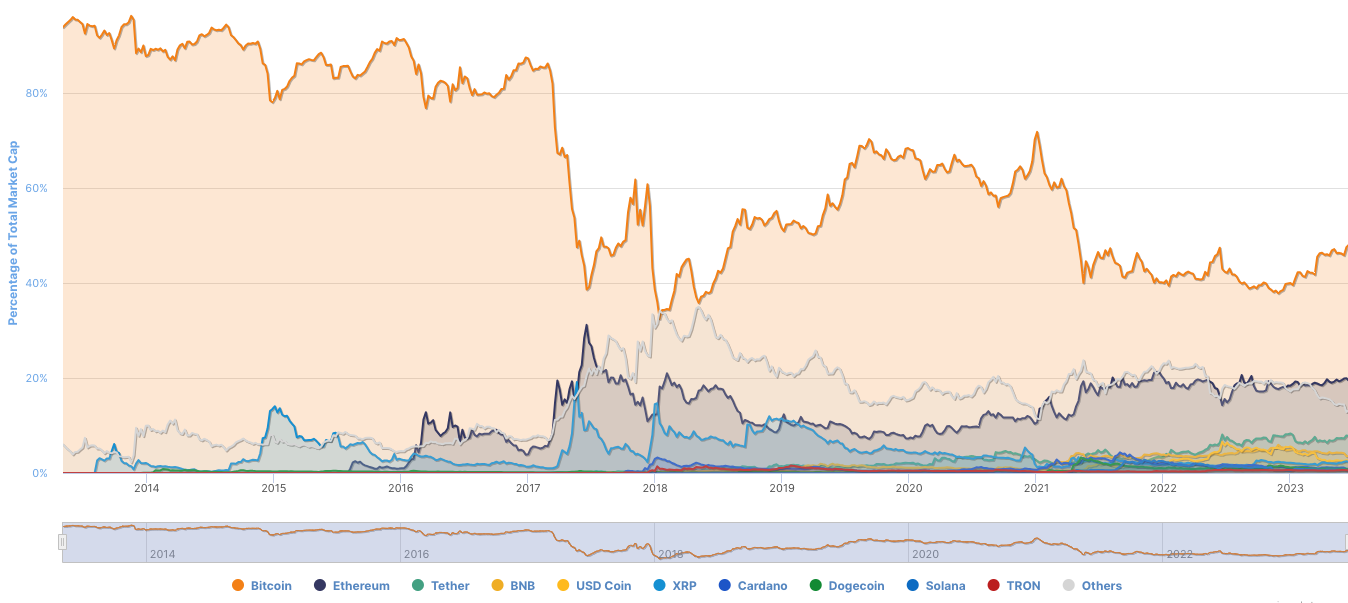

ETH’s value has experienced a notable 5% increase, reaching $1,814, a level it previously attained two weeks ago. This price surge may have caught traders off guard, particularly given the current market climate, which favors a 50% dominance by Bitcoin (BTC).

According to CoinMarketCap, Ethereum held a dominance of 19.42%, indicating potential challenges for altcoins to surpass BTC. As a result, the correlation between ETH and BTC movements may have puzzled market participants.

ETH could drop due to tired investors

ETH’s ascent beyond the $1,800 threshold can be attributed to the bullish momentum generated on June 15th, when it reached $1,650.

Despite a consistent upward trend in price, intermittent signs of buyer exhaustion have emerged. At a certain juncture, the soaring price was forced to halt at $1,748 due to weak demand.

Although there has been a push towards an upward trend, the possibility of ETH reverting to a bearish state remains. The 20-day EMA (blue) has dipped below the 50-day EMA (yellow).

Henceforth, the possibility of a further price surge seems improbable. If a sell-off surpasses the buying momentum, the $1,800 threshold may slip out of ETH’s grasp.

One potential factor that could impede the longevity of the altcoin’s price surge is the Directional Movement Index (DMI). Currently, the +DMI (blue) and -DMI (orange) stand at 21.79 and 23.41, respectively.

The proximity of these values suggests that the market remains evenly split, with neither buyers nor sellers holding complete sway.

The market is dominated by Longs

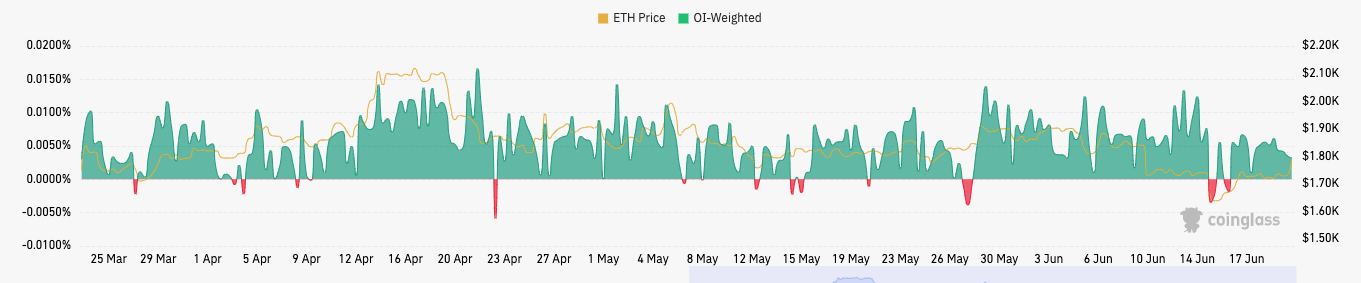

According to Coinglass, the derivatives market’s weighted funding rate was 0.0032%. This rate is crucial in maintaining the perpetual contract price in line with the underlying spot price.

A favorable funding rate for ETH indicates that long positions are charged a funding fee by short positions, reinforcing a bullish sentiment. Conversely, in the event of a negative funding rate, short positions would compensate for long positions to sustain a bearish stance.

The current funding rate is a potential harbinger of an impending market peak. However, this outcome is contingent upon the persistence of traders’ avarice.

The potential for a rally in ETH is currently uncertain. Should the broader market follow the impressive strides made in the first quarter, the possibility of another round of short liquidation cannot be ruled out.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.