- Polygon Labs unveils plan to create the Value Layer for the internet.

- The Value Layer initiative aims to democratize access to economic opportunities.

- The integration of ZK technology in Polygon 2.0 drives bullish trend for MATIC.

Polygon Labs, the trailblazing innovator behind Polygon 2.0, has unveiled its visionary plan to transform the internet by creating the Value Layer. This revolutionary enhancement entails completely reimagining Polygon, from protocol architecture to tokenomics to governance. The scope of this ambitious blueprint is set to revolutionize the digital landscape and establish a new standard of excellence.

Polygon’s groundbreaking Value Layer initiative seeks to level the playing field and make the global economy more accessible. By harnessing the power of decentralized finance, digital ownership, and innovative coordination mechanisms, we’re empowering individuals and communities to take control of their financial futures like never before. Join us in our mission to democratize access to the world’s economic opportunities and unlock a brighter future for all.

Unifying the Internet’s Potential:

The genesis of Polygon 2.0 is rooted in the visionary principles of Ethereum, which pioneered the revolutionary concept of the Value Layer, enabling frictionless exchange and programming of value without intermediaries. Nevertheless, the current crypto ecosystem, including Ethereum, requires greater scalability and cohesion akin to the broader internet.

Unleashing Limitless Scalability:

As the internet continues to expand limitlessly to accommodate the ever-increasing demands, individual blockchains face strict throughput limitations. However, with the introduction of Polygon 2.0, this challenge is being tackled head-on by creating a network of ZK-powered L2 chains interconnected via a groundbreaking cross-chain coordination protocol. This innovative solution is set to revolutionize the blockchain industry and provide a more efficient and effective means of meeting the demands of the modern world.

With our innovative network, users will enjoy a seamless experience as they navigate a highly scalable chain that can accommodate infinite chains. Our cutting-edge technology ensures secure and instantaneous cross-chain interactions, resulting in unparalleled scalability and unified liquidity. Trust us to provide a professional and reliable solution for all your networking needs.

Significant Price Implications:

The transition of Polygon to the Value Layer marks a momentous achievement for the MATIC market. With the integration of ZK technology, Polygon 2.0 provides unparalleled scalability and unified liquidity, positioning MATIC as a formidable asset for users seeking secure, efficient, and seamless value exchange. As a result, the heightened utility and demand for MATIC are expected to drive its market price to unprecedented levels. This development underscores the continued growth and innovation of the cryptocurrency industry.

MATIC Market Analysis

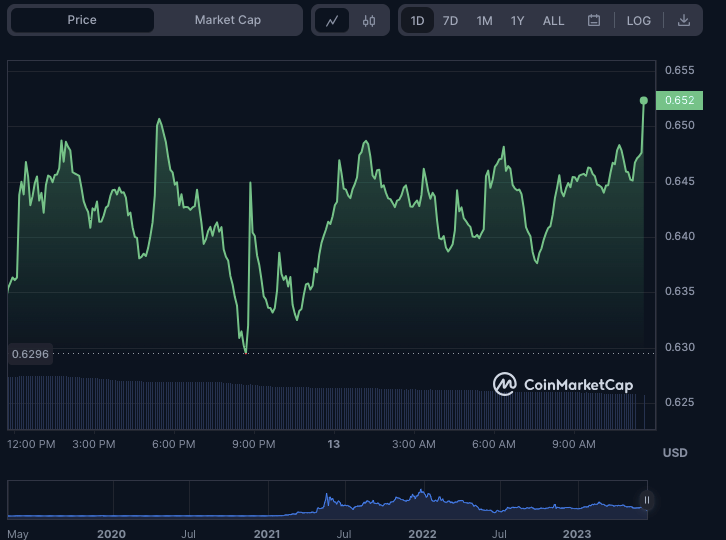

As a result of this strategic maneuver, the Polygon (MATIC) market has experienced a bullish trend over the past 24 hours, with the price surging from an intra-day low of $0.6288 to a 24-hour high of $0.6513.

The bullish hand remained in play at the time of publication, leading to a notable 2.16% surge in value to $0.6513.

During the recent bullish market, MATIC’s market capitalization experienced a notable 2.19% increase, reaching an impressive $6,027,729,414. However, the 24-hour trading volume declined 33.02%, settling at $382,164,496. This decrease in trading activity suggests that investors are holding onto their MATIC tokens, anticipating further price surges.

In summary, the migration of Polygon to the Value Layer through Polygon 2.0 has sparked a surge of optimism for MATIC, unleashing boundless scalability and cohesive liquidity and laying the foundation for unprecedented price peaks.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.