- Cardano’s ADA experiences notable upswing in Total Value Locked (TVL).

- TVL reaches peak for the year, with $159.3 million locked.

- Lending protocols like Aada and decentralized exchanges like Minswap play pivotal roles.

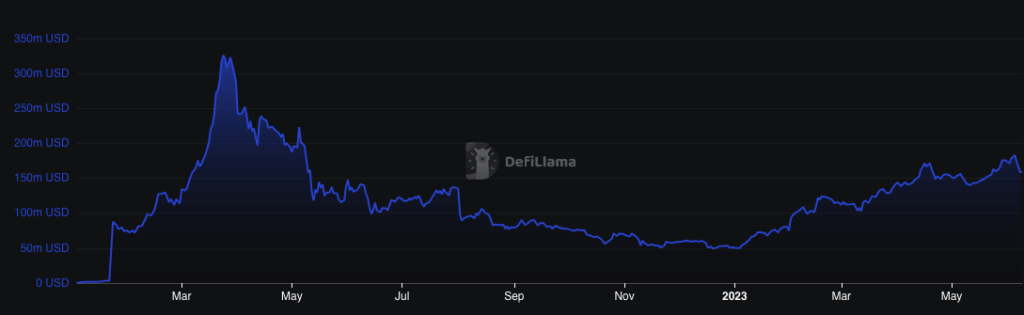

Cardano’s ADA has experienced a notable upswing in its Total Value Locked (TVL), reaching its peak for the year. TVL verifies the overall value of smart contract deposits within a Decentralized Finance (DeFi) protocol.

DefiLlama reports that Cardano has achieved a significant milestone with a total value locked (TVL) of $159.3 million. The multi-chain blockchain dashboard reveals that lending protocols like Aada and decentralized exchanges like Minswap have played pivotal roles in this achievement. These impressive figures demonstrate the growing popularity and adoption of Cardano within the DeFi ecosystem.

Over the past 30 days, Minswap has made a commendable contribution to the market with a 10.34% hike. However, ADA has truly taken the lead, boasting an impressive 75% increase within the same timeframe. This significant surge in TVL clearly indicates the growing adoption and utilization of the Cardano ecosystem. It is a promising sign for the future of the industry and a testament to the potential of these innovative technologies.

Although an increase in Total Value Locked (TVL) typically does not guarantee a significant price shift for ADA, there have been instances where this metric has provided additional impetus for the token’s momentum.

Despite its previous gains, ADA’s value has taken a hit over the last week, losing 14.67%. The 4-hour chart indicates that the token has been struggling with heightened selling pressure since the bullish structure break on May 4, leading to a drop in price to $0.357 the following day.

This could be ADA’s next destination

Despite attempts to increase its value, including ADA in the SEC’s list of regulated tokens hindered its progress. This added to the bearish sentiment, resulting in ADA plummeting to a low of $0.319.

Upon conducting a more in-depth analysis of the 4-hour timeframe, it was revealed that the Relative Strength Index (RSI) had plummeted to a mere 22.34. This numerical value indicates that the momentum of ADA had been significantly oversold.

The price may decline if ADA fails to establish a robust foundation of sturdy accumulation or attract many buyers. As a result, it is prudent to keep an eye on potential support levels below the $0.30 mark.

Despite the current bearish condition of ADA, Cardano has not allowed it to impede its developmental progress. On May 8, Input Output, its development arm, took to Twitter to emphasize the importance of collaboration and innovation within the ecosystem. This proactive approach demonstrates Cardano’s commitment to advancing despite market conditions.

In response to the SEC’s claims, Input Output has issued a statement refuting the allegations as inaccurate. The firm has emphasized that the filing contains numerous factual inaccuracies and will not impact IOG’s operations. Furthermore, IOG has clarified that ADA is not considered a security under U.S. securities laws. The tone of the statement remains professional and factual.

Holders may need to navigate this challenging market despite the current downward trend in ADA’s value. However, astute traders may view this as a chance to initiate short contracts, provided the momentum persists.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.