- Top 10 Ethereum self-custody whale addresses expand altcoin portfolio to $59.47 billion.

- Surge in Ethereum being moved into self-custody and DeFi options.

- Vitalik Buterin advocates for self-custody and multisig wallets for enhanced security.

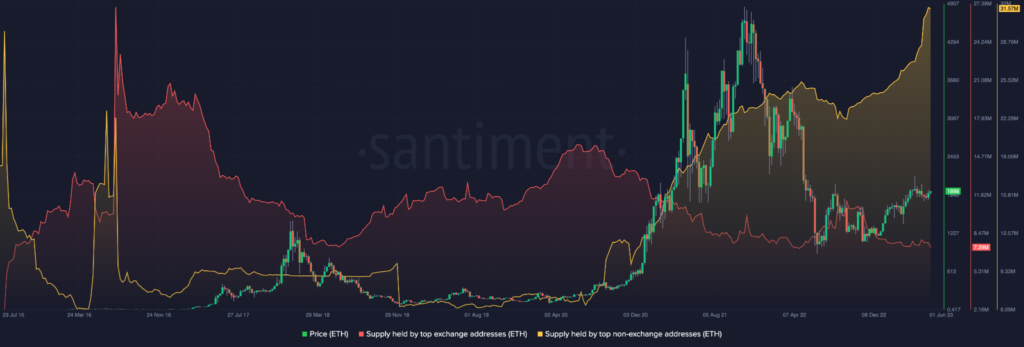

According to Santiment’s recent report, the top 10 Ethereum (ETH) self-custody whale addresses have expanded their altcoin portfolio. As of June 5, these whales now possess a staggering $59.47 billion combined holdings.

The official account of the on-chain analytic platform recently shared a tweet highlighting the increasing trend of Ethereum being moved into self-custody and DeFi options. This has resulted in a surge of coins being absorbed by the largest whale addresses on the network. The 10 largest non-exchange addresses now hold an impressive 31.8 million $ETH, valued at a staggering $59.47 billion – an all-time high. These figures are a testament to the growing popularity of decentralized finance and the increasing trust in self-custody options.

According to the data provided by Santiment, a noteworthy surge commenced in the previous year. This upswing was accompanied by a decline in the exchange supply held on exchanges (indicated in red), which has plummeted rapidly since September 2022.

Heeding the founder’s call

This decision may be attributed to Vitalik Buterin’s advocacy for self-custody, which he has emphasized on two occasions.

In November of 2022, the esteemed co-founder of Ethereum issued a compelling call to action for the crypto community to divest their assets from centralized platforms. This imperative came at the FTX collapse, which he deemed a manifestation of inherent malevolence within exchanges.

On March 17, he reiterated his stance with unwavering conviction. In his astute analysis, he proposed the implementation of multisig wallets as a viable solution. Additionally, he pointed out that adopting ERC-4337 could effectively tackle the apprehensions surrounding custodial storage.

Multisig wallets, also known as multi-signature wallets, provide an added layer of security by requiring multiple cryptographic keys to authorize transactions. This advanced feature ensures that only authorized parties can access and transfer assets, mitigating the risk of unauthorized access and theft. In addition, the Ethereum standard ERC-4337 offers an innovative solution to enhance asset safety through biometric signing of transactions. This cutting-edge technology leverages biometric data, such as fingerprints or facial recognition, to authenticate transactions, further bolstering the security of digital assets. Together, these advanced security measures provide a robust and reliable framework for safeguarding valuable assets in the digital realm.

In addition to bolstering security measures, the recent migration of these whales may also signal a promising outlook for the long haul. However, if the influx of supply onto exchanges were to follow suit, it could lead to a decline in the value of ETH.

Currently, the current intra-day trading price of the altcoin stands at $1,869, as reported by CoinMarketCap. However, it is worth noting that this figure reflects a slight decline of 1.68% over the past seven days.

ETH’s momentum is tilting toward the bearish area

From May 29 to the present, the 4-hour chart indicates that ETH’s trading range has fluctuated between $1,846 and $1,916. Notably, on June 1, an upswing occurred after encountering resistance at $1,903 on June 3.

Although there was a slight shift in the market structure, ETH predominantly pulled back from its upper range. Unless the bear market gives way to pressure or Bitcoin (BTC) surges beyond the $26,000 threshold, the bullish trend may encounter obstacles in overcoming the current downtrend.

Furthermore, purchasers have encountered a formidable obstacle in their quest to reclaim authority, as evidenced by the Relative Strength Index (RSI). As of the current moment, the momentum gauge stands at 40.43.

The current state of affairs indicates that the market has approached the oversold threshold of 30, which can be attributed to potential profit-taking activities in the vicinity of $1,908-$1,904.

Based on the current trend, ETH may experience a bearish movement. However, if the accumulation of whales persists over the long term, there is potential for the altcoin to rally.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.