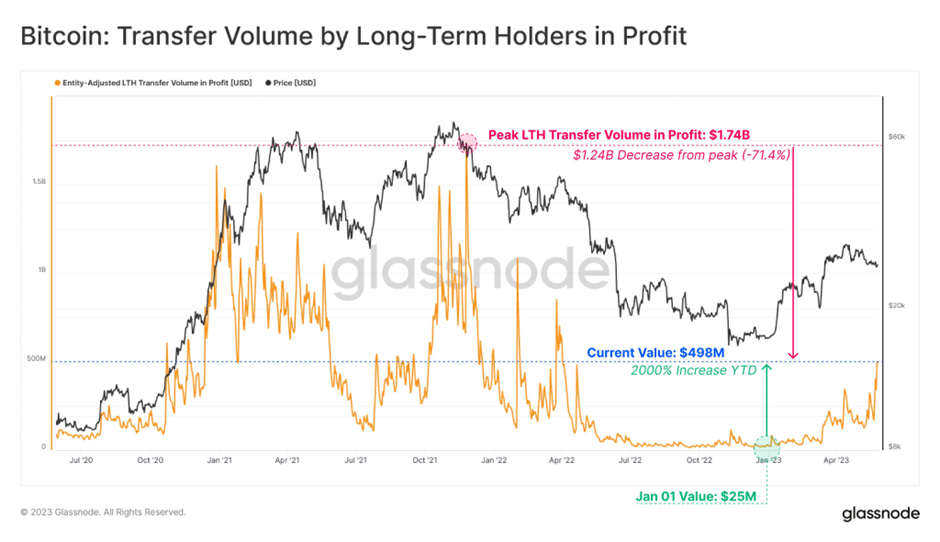

- Bitcoin transfer volume by long-term holders surged 2000% to $489 million.

- BTC profits from transfer volume decreased by 71.4% from peak.

- 6-12 month Bitcoin holders are the most significant spenders.

According to Glassnode, a data analytics platform, there has been a significant increase in the Bitcoin transfer volume sent by long-term holders in profit this year. The figures show a remarkable surge from $25 million to $489 million, representing an impressive 2000% rise.

Despite this, the transfer volume generating BTC profits amounts to $1.24 billion, marking a 71.4% decrease from the peak of $1.74 billion observed during the 2021 Bull Market.

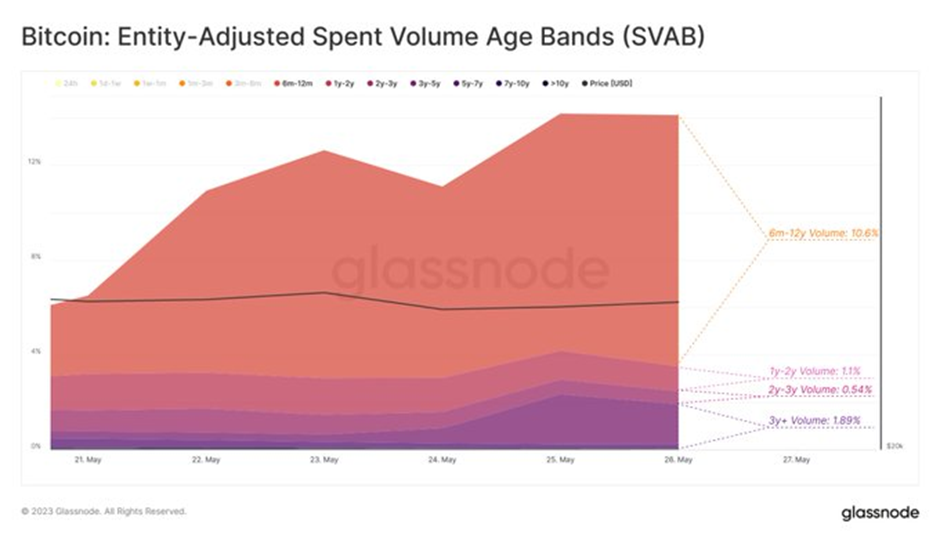

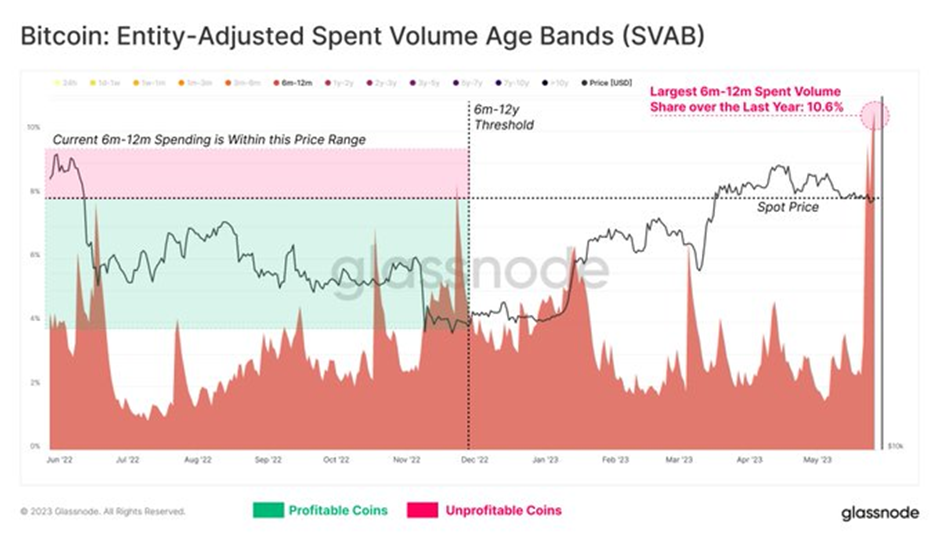

Upon analyzing the distribution of Bitcoin long-term holder (LTH) spending across different age groups, Glassnode has observed that the 6-month to 12-month cohort emerges as the most significant spenders. Their transfer volume is three times higher than all other LTH cohorts that have held Bitcoin for a year or more. This finding sheds light on the spending behavior of Bitcoin holders and highlights the importance of understanding the dynamics of different age groups in the cryptocurrency market.

In addition, Glassnode’s analysis of the spending range for coins aged between 6 to 12 months reveals a noteworthy observation. Out of a possible 183 acquisition days, a staggering 92% or 167 days are profitable compared to the current spot price. This crucial information provides valuable context to the surge in profitable transfer volume and the high volume of spending within this age cohort. Overall, this data underscores the importance of considering the age of coins when analyzing market trends.

Furthermore, as highlighted in a prior tweet, Glassnode has observed that the Bitcoin market persists in unrealized gains, with the current supply in profit nearly doubling that in loss, boasting a ratio of 1.9 to 1.

It is worth noting that the current Supply in Profit and Loss Ratio while showing a positive trend, remains significantly lower than the peak witnessed during the exuberant 2021 Bull Market. During that period, the ratio skyrocketed to an astonishing 554.5, indicating a substantially higher level of market profitability.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.