CryptoQuant, the on-chain analytics platform, recently took to Twitter to share insights on Bitcoin’s prospects for the remainder of the year. According to their post, BTC still holds the potential for further growth, but several factors could impede its upward trajectory. As a professional source of information, CryptoQuant’s analysis provides valuable insights for investors and traders alike.

US institutional investors’ decrease in BTC holdings has emerged as a crucial determinant of its growth trajectory. In the past, during bullish markets, these investors’ BTC holdings have been linked to substantial price hikes.

Over the past few months, there has been a noticeable decline in these holdings. As per CryptoQuant’s analysis, this trend can be attributed to institutional investors now gravitating towards global exchanges and decentralized exchanges (DEXs) due to the ongoing regulatory measures enforced by the Securities and Exchange Commission (SEC) in the crypto market.

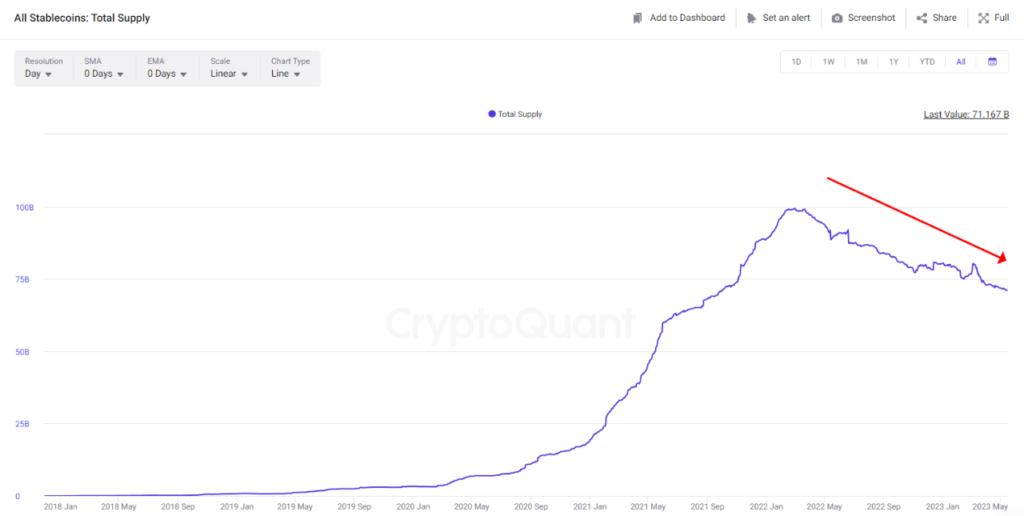

One of the factors currently impeding BTC’s upward trajectory is the reduction in the supply of stablecoins. This decrease in stablecoin supply can be viewed as a gauge of the purchasing potential within the cryptocurrency market. Since hitting a high of $99 billion in February 2022, the total supply has dwindled to $71.1 billion, indicating a decline in the overall buying power.

Finally, CryptoQuant has highlighted that the need for more new smart money participants hinders BTC’s upward potential. The BTC Token Transfer gauge has indicated a dearth of noteworthy alterations, implying that the recent price fluctuations are primarily influenced by supply and demand factors rather than the influx of new smart money.

While BTC has shown promise for future price hikes, CryptoQuant has forecasted that macroeconomic conditions, including an impending recession in the latter part of this year, may trigger a decline in asset prices. Consequently, it is improbable that BTC will experience a sustained upward trend similar to 2015.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.