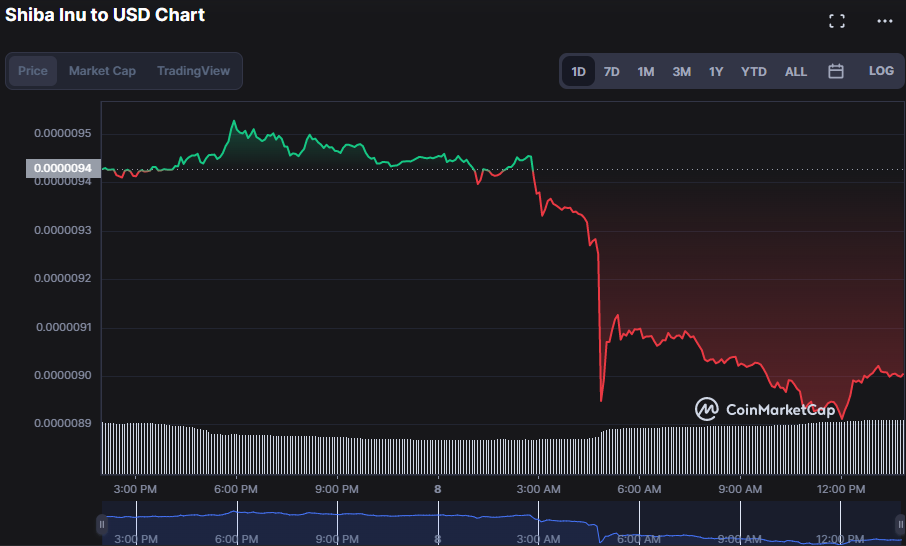

Despite the strategic token burning of approximately 1.69 billion ($17,000) on May 5th in Shiba Inu (SHIB) aimed at bolstering the value of the remaining tokens, the price has unfortunately plummeted to a 90-day low of $0.000008906 within the last 24 hours.

At the time of publication, the market remained under the influence of bearish sentiment, leading to a decline of 4.35% to $0.00000901.

Amidst the market downturn, the SHIB’s market capitalization experienced a 4.35% decline, settling at $5,311,997,840. However, the 24-hour trading volume witnessed a 6.63% surge, reaching $144,711,296. This upswing in trading activity could be attributed to traders capitalizing on the price dip to acquire more SHIB tokens.

According to the SHIB/USD price chart, the Rate of Change (ROC) trend currently stands at -4.92, indicating a robust bearish momentum that is expected to persist. This suggests that the market is experiencing a surplus of sellers, resulting in a rapid price decline.

For traders looking to short the market, the current moment presents a prime opportunity to establish a position. Conversely, those who are long may want to contemplate securing profits or implementing stop-loss orders. It’s prudent to assess the market and make informed decisions based on your trading strategy.

According to the Price Volume Trend analysis, the SHIB market is currently grappling with a robust negative momentum, as evidenced by the reading of -2.836B. This suggests that the market is currently dominated by sellers, leading to a price decline. If this trend persists and the PVT continues to plummet, it could signal a further downturn in the SHIB market.

According to the stochastic RSI, the SHIB/USD market is experiencing significant bearishness with a reading of 0.00, which has fallen below its signal line. Despite this, the market is oversold, which may lead to a short-term rebound as traders capitalize on the low prices.

The bearish trend is reinforced by the technical analysis indicating a “strong sell” on the SHIB price chart, indicating significant selling activity.

Despite the recent token burn, SHIB’s price has plummeted to a 90-day low. As a result, traders may want to consider shorting the market, while long traders may want to take profits or place stop-loss orders. It’s important to stay vigilant and make informed decisions during market volatility.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.