Renowned crypto analyst, Aurelien Ohayon, also known as TAnalyst, recently took to Twitter to share his astute observations on the current state of the crypto market leader, Bitcoin (BTC). According to his expert analysis, BTC is poised for a bullish run, with potential gains on the horizon. Ohayon’s prediction may be attributed to his strategic placement of bets on the highly anticipated Bitcoin halving event, scheduled for April 2024. As a seasoned professional in the field, Ohayon’s insights hold significant weight and are worth considering for any serious investor.

Based on the insightful infographics shared on Twitter, TAnalyst’s projections suggest that if BTC continues to adhere to its current linear regression trend, it could soar to a staggering $200K by 2024.

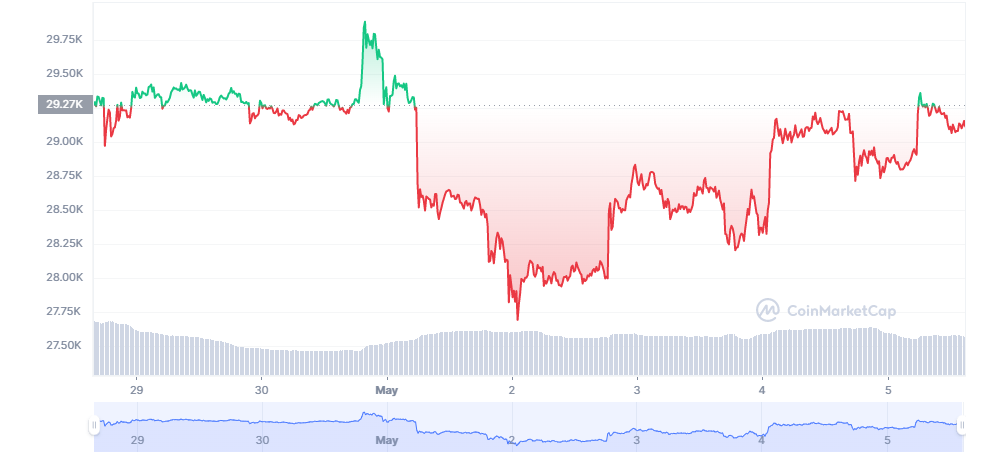

As per the latest update from CoinMarketCap, the current value of BTC stands at $29,113.11, reflecting a slight dip of 0.38% over the past 24 hours.

Bitcoin (BTC) currently reigns supreme as the top-ranked cryptocurrency on CoinMarketCap, boasting an impressive 24-hour trading volume of $15,975,921,546 and a live market cap of $563,766,994,045. With a circulating supply of 19,364,712 BTC coins and a maximum supply of 21,000,000 BTC coins, Bitcoin’s dominance in the crypto world is undeniable.

In late April, BTC experienced a period of consolidation, reaching three consecutive monthly highs. The early days of May saw a promising uptick in value, but unfortunately, the trend was short-lived. BTC began to decline as the month progressed and has remained in the red ever since. Throughout May, BTC hit four monthly lows, with only one instance of surpassing the opening market price on May 5th, when it reached a value of $29,460.12.

Upon analyzing the chart presented, it is evident that BTC is experiencing an upward trend and steadily rising within the linear regression. Should BTC maintain its current trajectory within the linear regression, it has the potential to reach Resistance 2 at $47.9K. However, it is important to note that BTC may encounter Resistance 1 as a formidable obstacle on its journey towards Resistance 2.

In the scenario where BTC encounters Resistance 1, it may pivot towards seeking support at the $32.4K mark. Nevertheless, if this support fails to catalyze BTC’s next bullish surge, we may anticipate multiple attempts at testing Resistance 1 and a period of consolidation.

BTC has experienced brief periods of consolidation in recent months, which have been followed by significant drops. Additionally, every contraction of Bollinger bands has been succeeded by an expansion. As a result, if this current calm is indeed the precursor to a storm, BTC may experience a fall, potentially landing on Support 2. The question remains, however, whether this will occur in light of the impending halving. We must wait and see.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.