The esteemed crypto education and analysis platform EGRAG CRYPTO (@egragcrypto) recently took to Twitter to provide valuable insights into the potential price movements of Ripple (XRP) shortly. Utilizing advanced technical analysis tools such as the Regression Channel and Bollinger Bands, the platform delved deeper into XRP’s charts to comprehensively understand its trajectory. This meticulous approach is a testament to EGRAG CRYPTO’s commitment to providing accurate and reliable information to its followers.

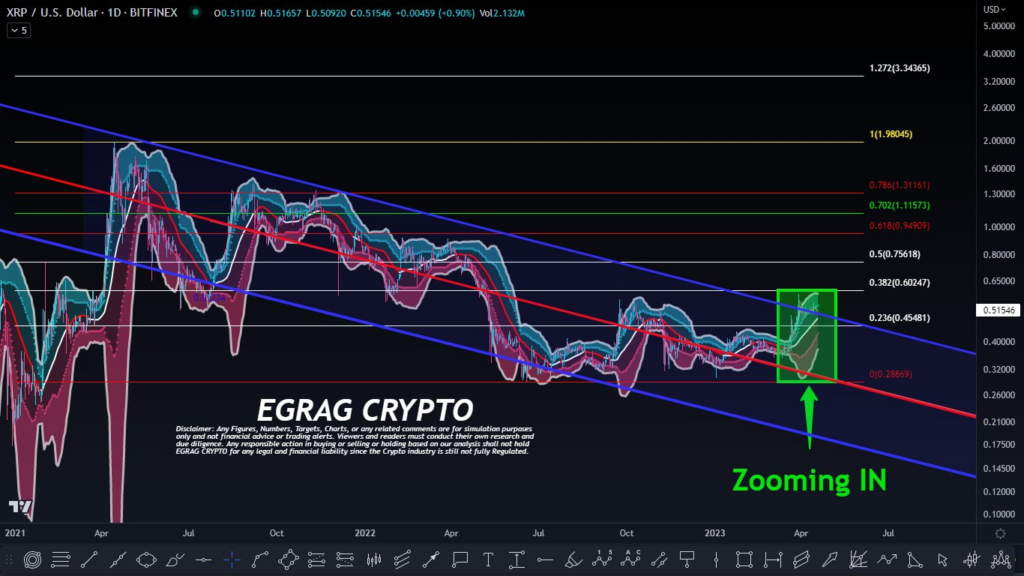

EGRAG CRYPTO has analyzed the Bollinger Bands and determined that XRP has the potential to reach a higher price of $0.58 if it can successfully close above these bands. Additionally, the recent bounce of XRP’s price from the top end of the Regression Channel is a positive sign for the cryptocurrency, indicating that bullish investors are determined to maintain the $0.50 mark. These technical indicators suggest a promising outlook for XRP’s future performance.

According to EGRAG CRYPTO, the possibility of XRP hitting $0.48 remains viable as long as Bitcoin (BTC) remains in a range. However, they do not anticipate the altcoin revisiting this level. While there is a chance that XRP may dip to the range of $0.43 to $0.37, EGRAG CRYPTO believes that this scenario is contingent on BTC testing the $25k to $27k range.

According to the latest update from CoinMarketCap, XRP is currently trading at $0.5167, reflecting a modest 0.47% surge in price over the past 24 hours. XRP has demonstrated its resilience against BTC and Ethereum (ETH), with gains of 1.10% and 0.35%, respectively, during the same period. Despite these positive developments, XRP has experienced a slight dip of 1.45% over the past week.

XRP’s trading volume has surged by over 11% since yesterday, placing it in the green zone with a 24-hour trading volume of $928,746,477. Its impressive market cap of $26,728,113,941 has secured its position as the 6th largest cryptocurrency in market capitalization. These figures reflect the growing confidence in XRP’s potential and its ability to deliver value to investors.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.