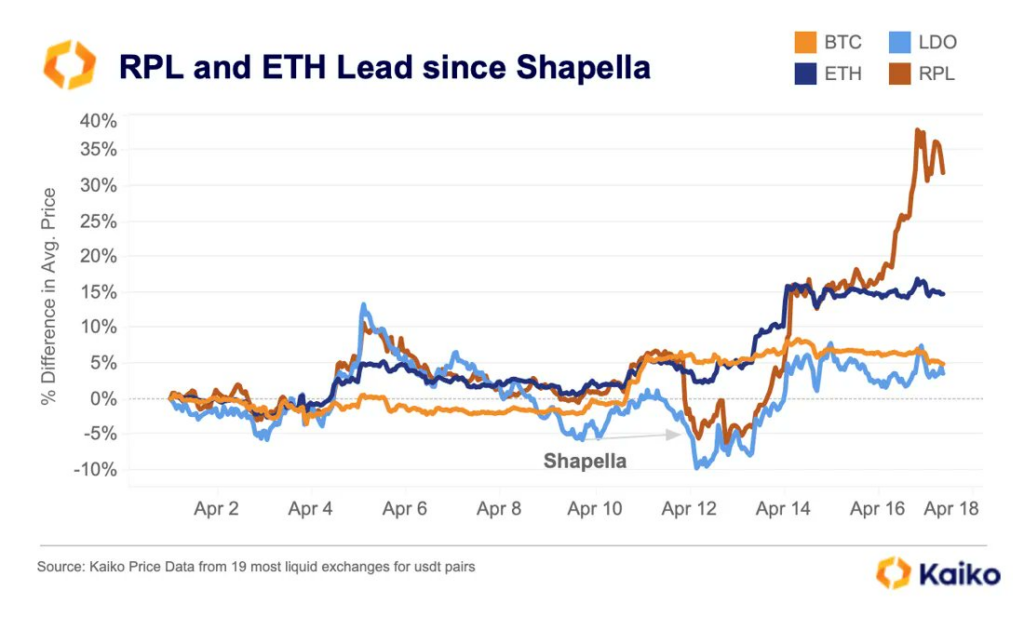

According to a tweet from Kaiko (@KaikoData), the blockchain intelligence platform Rocket Pool (RPL) has emerged as a top performer since the Shapella Fork launch, surpassing both Bitcoin (BTC) and Ethereum (ETH). RPL has also outperformed its closest competitor, Lido DAO (LDO). These results showcase the strength and potential of Rocket Pool in the current market.

According to the analytics platform, Rocket Pool’s Atlas upgrade is set to revolutionize the market by enabling smaller 8 ETH staking nodes. This development can significantly boost Rocket Pool’s market share and position it as a formidable competitor to Lido, the current leader in liquid staking protocols. These advancements are a testament to Rocket Pool’s commitment to innovation and unwavering dedication to providing top-notch services to its clients.

RPL’s value is hovering at $54.09, as per CoinMarketCap’s latest report, indicating a 9.67% drop in the past 24 hours. The altcoin has also experienced a decline of 8.40% and 9.25% against BTC and ETH, respectively. However, despite the recent slump, RPL’s weekly performance is still in positive territory, with a growth rate of over 13%.

LDO’s value has experienced a 1.60% decline within the past 24 hours, settling at $2.49 as of press time. In a parallel fashion to RPL, LDO has also displayed a decrease in strength against BTC and ETH over the same time frame. As of now, LDO has depreciated by 0.01% against BTC and 0.99% against ETH.

LDO’s market capitalization currently stands at an impressive $2,170,530,284, securing its position as the top liquid staking protocol and placing it at number 31 on CoinMarketCap’s list of the most significant crypto ventures by market cap. In contrast, RPL holds the 54th spot on the list, with a market cap of $1,051,685,151. These figures demonstrate the robustness and competitiveness of both projects in the ever-evolving crypto landscape.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.