According to a recent tweet from Santiment, a leading blockchain analytics firm, the exchange supply of Ethereum (ETH) has hit a record low not seen in almost half a decade. The tweet also highlighted that ETH had become a popular choice for self-custody, especially after the FTX debacle. These findings suggest a growing trend towards greater control and security over digital assets.

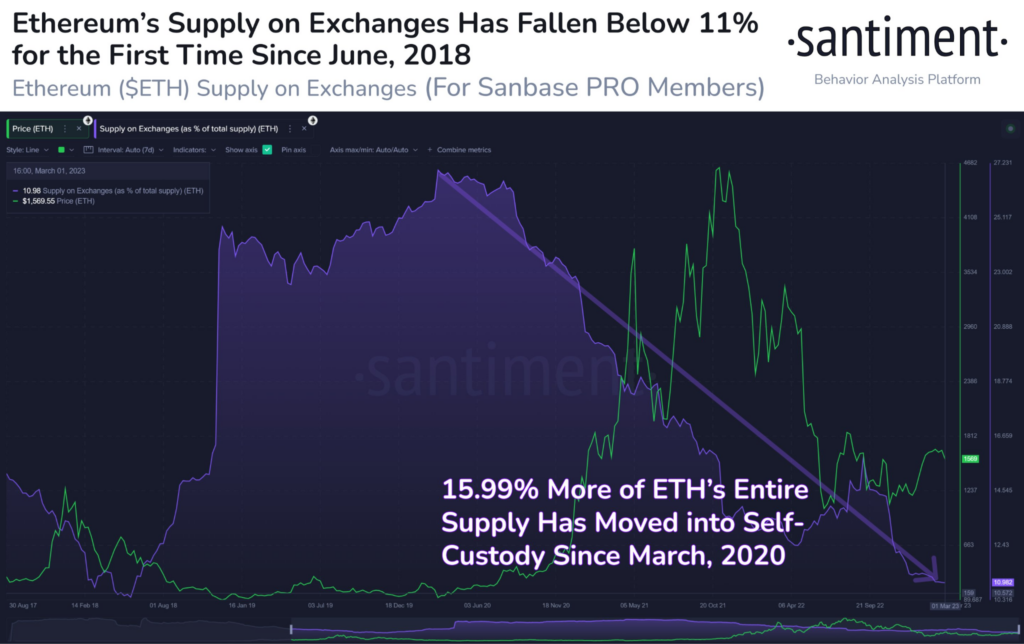

Furthermore, the tweet disseminated a visually compelling graphic highlighting a significant Ethereum ecosystem development. Specifically, the data reveals that the amount of ETH held on exchanges has dipped below 11%, marking the first time since June 2018. Additionally, an impressive 15.99% of the ETH supply has migrated into self-custody since March 2020. This shift towards self-custody is a promising sign, indicating a reduced likelihood of a future selloff. Overall, these findings suggest a positive trend for the Ethereum community.

According to the latest update from CoinMarketCap, the current price of ETH has experienced a slight dip of 0.01% over the past 24 hours. This drop has contributed to its negative weekly performance, which now stands at -1.89%. As a result, the leading altcoin’s current value is $1,568.67. Additionally, ETH has shown a 0.06% increase in strength against Bitcoin (BTC).

Moreover, the overall market capitalization of ETH has experienced a significant surge, currently standing at an impressive $192,105,666,224.

The trading volume for ETH has experienced a significant decline of 30.92% within the past 24 hours, resulting in a total daily trading volume of $6,638,140,432. The cryptocurrency is trading close to its 24-hour high of $1,575.87, with a daily low of $1,552.45. These figures indicate a notable shift in the market, requiring careful consideration and analysis for investors and traders alike.