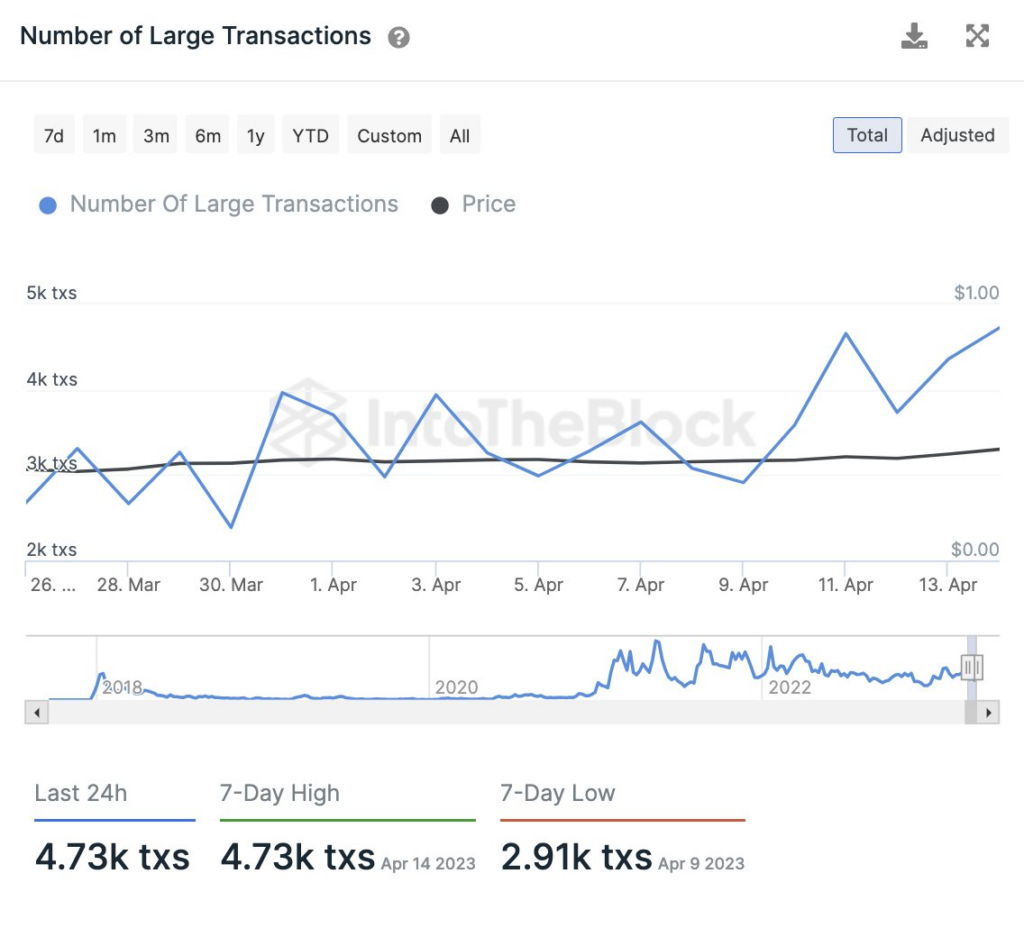

This morning, Ali (@ali_charts), a seasoned crypto trader, took to Twitter to share some intriguing news. There has been a noticeable surge in large-scale transactions involving Cardano (ADA) lately. This uptick in activity clearly indicates that institutional players and whales are starting to move within the Cardano network. As such, it’s safe to say that the Cardano ecosystem is heating up, and we can expect some exciting developments shortly.

The trader astutely shared a snapshot of data from the esteemed blockchain tracking firm, IntoTheBlock. The data revealed a staggering 4.73k transactions had transpired within the last 24 hours, marking a 7-day high for the network’s transaction activity. Ali, the trader, confidently interpreted this as a bullish sign for the Cardano network and its native token, ADA.

According to CoinMarketCap, the current value of ADA stands at $0.4491, reflecting a 2.60% surge in the past 24 hours. This impressive growth has further bolstered ADA’s already impressive weekly performance, with its value soaring by over 15% in the last 7 days.

In the past 24 hours, ADA has demonstrated its resilience by outperforming the two dominant players in the crypto market, Bitcoin (BTC) and Ethereum (ETH). ADA’s price has surged by 3.68% against BTC and 3.04% against ETH, showcasing its strength and potential for growth. These results testify to ADA’s ability to hold its own in a highly competitive market and solidify its position as a promising investment opportunity.

The trading volume of ADA has experienced a slight dip in the past 24 hours. Currently, the estimated daily trading volume for ADA stands at $565,203,706, indicating a 21.65% decrease from yesterday’s trading volume.

There is a strong possibility that ADA’s price will reach a new daily high by the end of today’s trading session, as it is currently trading near its 24-hour high of $0.4489. It is worth noting that the altcoin’s 24-hour low currently stands at $0.4274 when writing.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.