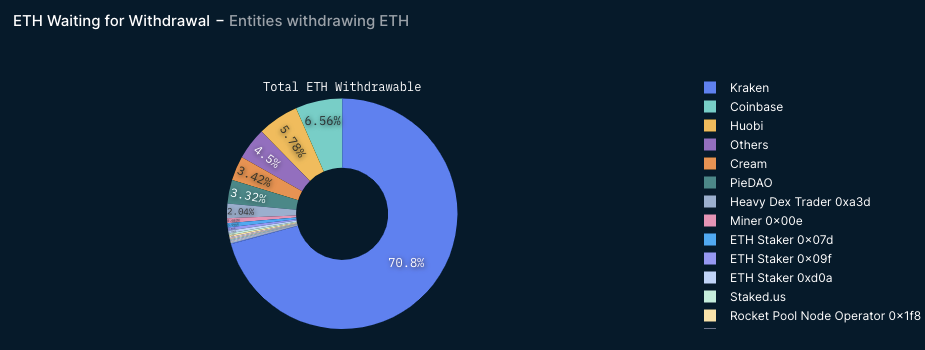

A recent analysis conducted by Nansen has revealed that Kraken, the US-based cryptocurrency exchange, is currently leading the pack in terms of the amount of staked ETH awaiting withdrawal. The report indicates that Kraken has secured a whopping 70.8% of the total ETH waiting to be withdrawn, cementing its position as a dominant player in the crypto market. These findings testify to Kraken’s unwavering commitment to providing top-notch services to its clients and its ability to stay ahead of the curve in an ever-evolving industry.

According to the report, several prominent exchange platforms are poised to terminate their ETH staking programs. Coinbase leads the pack with 6.56% of total withdrawable ETH, followed closely by Huobi, a Seychelles-based cryptocurrency exchange, with 5.78%. Meanwhile, “Others” claimed the fourth spot with a 4.5% share of the total withdrawable ETH, while Cream, an open source and blockchain-agnostic protocol, held 3.42% at publication. These findings underscore the shifting landscape of the cryptocurrency market and the need for investors to stay informed and adaptable.

According to cryptocurrency enthusiasts on Twitter, the recent surge in ETH-staked withdrawals on Huobi can be attributed to the transition of new and old shareholders. Allegedly, the founder of Huobi, Li Lin, was compelled to perform a handover once the withdrawal was initiated, resulting in the need to withdraw some ETH from the exchange and subsequently deposit it back. This process may have caused an increase in the number of withdrawals and deposits, potentially contributing to the platform’s recent spike in ETH withdrawals.

The latest development in the world of Ethereum is the Shanghai (Shapella) Upgrade, a comprehensive overhaul that encompasses modifications to Ethereum’s execution layer (Shanghai upgrade), consensus layer (Capella upgrade), and the Engine API. With the Shanghai update already in effect, Ethereum is now fully transformed into a “proof of stake” blockchain, which consumes 99% less energy than the “proof of work” blockchain that powers the Bitcoin network. This significant shift marks a major milestone in the evolution of Ethereum and reinforces its position as a leading player in the blockchain space.