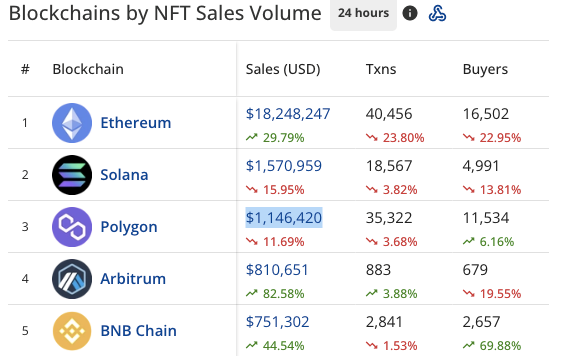

According to data from Cryptoslam, Polygon (MATIC) has experienced a decline in NFT sales volume, resulting in Solana (SOL) taking second place on the leaderboard. This significant shift in the market is evidenced by Polygon’s sales volume dropping by 11.69% in the past 24 hours, settling at $1,146,420. As the NFT sector evolves rapidly, Solana has emerged as a major player.

Solana, the runner-up in the stock market, has impressively generated a sales volume of $1,570,959. However, Ethereum is the top NFT sales volume game player. With Solana’s emergence as a transformative force in the NFT market, this recent development has significantly shifted the on-chain mindset.

According to market analysts on Twitter, Solana’s ascent to the summit of the NFT sales volume chart is an undeniably remarkable feat, considering the platform’s relative youth. The substantial surge in sales volume is a testament to Solana’s ability to leverage the Ethereum network’s reliability while addressing scalability challenges.

Furthermore, it is projected that the platform will sustain its upward trajectory in sales owing to the escalating interest in NFTs, cementing its position as a trailblazer in the NFT landscape.

Reddit, the renowned social networking platform, has unveiled its latest NFT collection on Polygon, featuring numerous unique digital artworks crafted by over a hundred talented artists. The third iteration of Reddit’s NFTs is poised to be the most impressive and expansive yet. The transition to Polygon makes the collection more accessible to the NFT community, opening up new avenues for collectors and artists.

According to the latest data from CoinMarketCap, SOL is currently trading at $24.11, reflecting a notable 1.1% increase over the past 24 hours. Meanwhile, MATIC, the digital asset of Polygon, is being exchanged at $1.11, showcasing a 1.95% gain within the same timeframe.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.