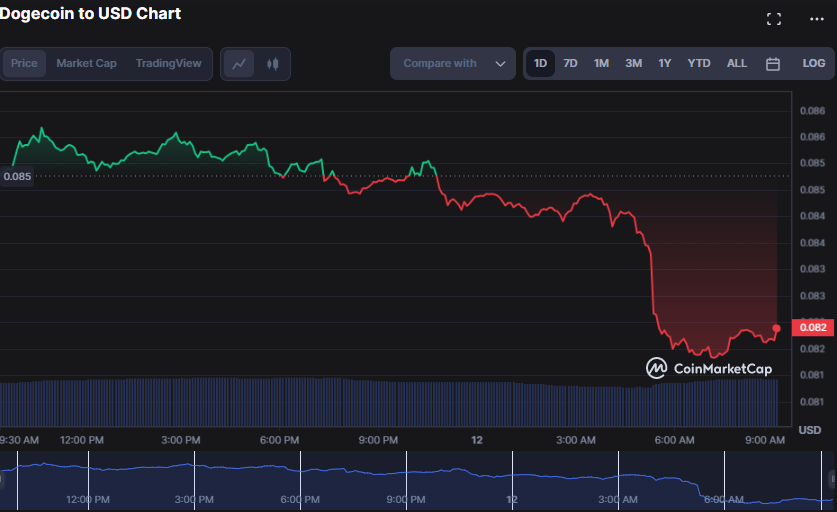

The Dogecoin (DOGE) market experienced a positive start to the day, with a surge in price reaching a high of $0.08571. However, resistance at this level led to a retracement to $0.08132, where support was established. Unfortunately, the bears took over the DOGE market, resulting in a 3.33% drop from the day’s high to $0.08176 at press time. Despite this setback, the market remains dynamic and subject to change.

Amidst the economic downturn, the market capitalization experienced a 3.30% decline, settling at $11,355,178,152. However, the 24-hour trading volume witnessed an 11.96% surge, reaching $548,639,708. This upswing in trading activity indicates that investors actively buy and sell, possibly leveraging the lower prices during the correction to enter or exit their holdings.

If the current bearish trend persists, keeping a close eye on the next support levels would be prudent. Should the 0.08132 support level be breached, potential support levels to monitor include 0.07798 and 0.07462. However, if market sentiment shifts and buyers regain control, it would be wise to pay attention to the resistance levels at 0.08654 and 0.09021. As always, a cautious and informed approach is recommended in navigating the ever-changing landscape of the financial markets.

According to the Average Directional Index value of 20.98 on the DOGE price chart, the negative momentum appears weak, indicating a potential trend stabilization. This ADX level can instill greater confidence in traders seeking to initiate long positions on DOGE, as it suggests that the market is not experiencing significant movement in either direction, thereby presenting potential profit opportunities.

The current BOP rating of 0.29, coupled with its upward trend, suggests that the bearish momentum is subsiding, potentially paving the way for the bulls to take charge of the market. This presents a promising opportunity for those considering investing in DOGE.

The burgeoning BOP trend is gaining momentum, fueled by an upswing trade volume and a positive outlook on DOGE. This shift in market sentiment indicates a potential shift towards a more optimistic perspective, further bolstering the trend’s growth.

The 3-hour price chart’s Rate of Change (ROC) has dipped below the “0” line, settling at -3.20 in negative territory. This shift suggests that DOGE’s bearish trend is intensifying, with the price decline gaining momentum. As a result, traders may want to explore potential short-selling prospects.

The Relative Strength Index (RSI) currently stands at 36.63, indicating a downward trend as it slips below its signal line. This negative outlook is further compounded by the oversold status of DOGE, which may experience a brief uptick before resuming its downward trajectory. However, the overall trend remains pessimistic until the RSI surpasses its signal line.

If the Relative Strength Index fails to rebound and instead experiences a continued decline, DOGE may have additional downside risk in the immediate future.

The DOGE cryptocurrency has demonstrated remarkable resilience in its recent recovery from lows, attracting renewed investor interest. However, it is important to exercise caution as the currency consolidates within a weak trend. Prudent decision-making and a thorough understanding of market dynamics are essential for successful investment in this volatile space.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.