The beginning of 2023 has proven to be a favorable period for BTC, with the cryptocurrency experiencing a year-to-date increase of approximately 69%. Recently, CryptoQuant presented a compelling thesis regarding the future price trajectory of Bitcoin (BTC). The central premise of the thesis suggests that BTC has the potential to reach $100,000 by 2024.

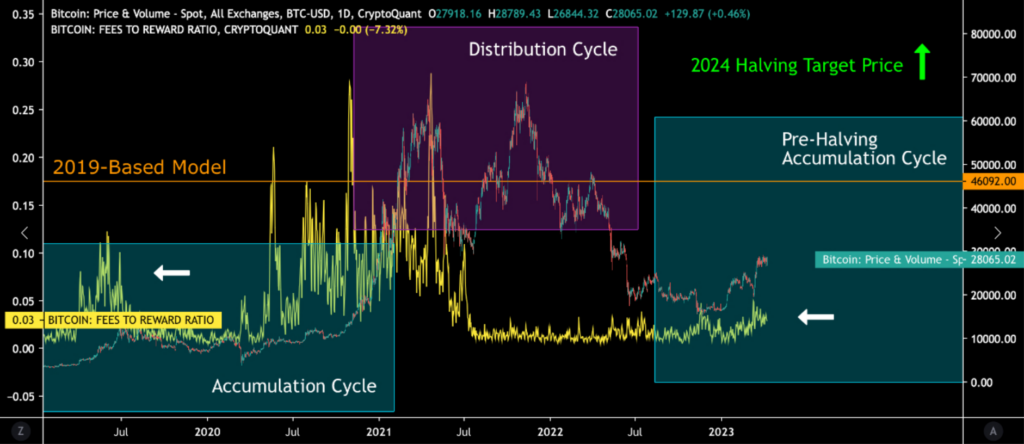

The thesis highlights a noteworthy observation regarding the accumulation cycle of 2019, where the fees-to-reward ratio experienced a significant surge, peaking at 0.12 before the summer relief rally. A similar trend was observed in 2020, with the ratio reaching 0.29 in November. The latest report suggests that the fees-to-reward ratio is on the rise again. These findings shed light on the importance of monitoring this crucial metric for informed decision-making in the cryptocurrency market.

The author highlights the impending achievement of Bitcoin as it inches closer to the predicted $46,092 price level forecasted in 2019. The leading cryptocurrency is expected to reach this milestone by the summer of 2023. Furthermore, the author underscores the significance of Bitcoin’s upcoming halving event, which some speculate could occur as early as April 2024.

The author’s thesis culminated in the assertion that should BTC attain the anticipated price point of $46,092, achieving a $100,000 valuation following the 2024 halving would be a feasible feat for the foremost player in the cryptocurrency market.

Bitcoin has had a dynamic 24 hours, with the cryptocurrency currently trading at $30,061.48 as of press time. According to CoinMarketCap, BTC’s price has surged by 6.24% over the past day. Additionally, BTC has maintained a steady upward trend, with a 7% increase over the last seven days. These developments indicate a promising outlook for the cryptocurrency market.

BTC’s 24-hour trading volume has surged by over 90% since yesterday, reaching an impressive $23,788,863,100 and firmly placing it in the green zone. This metric is a testament to the robustness of the cryptocurrency market and the growing interest in BTC.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.