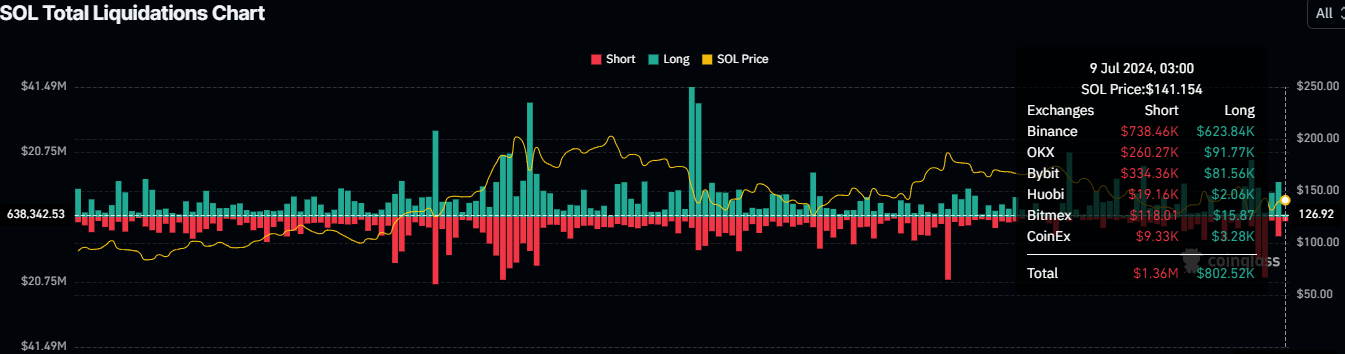

- Solana faces over $2.16 million in liquidations, with $1.36 million from shorts.

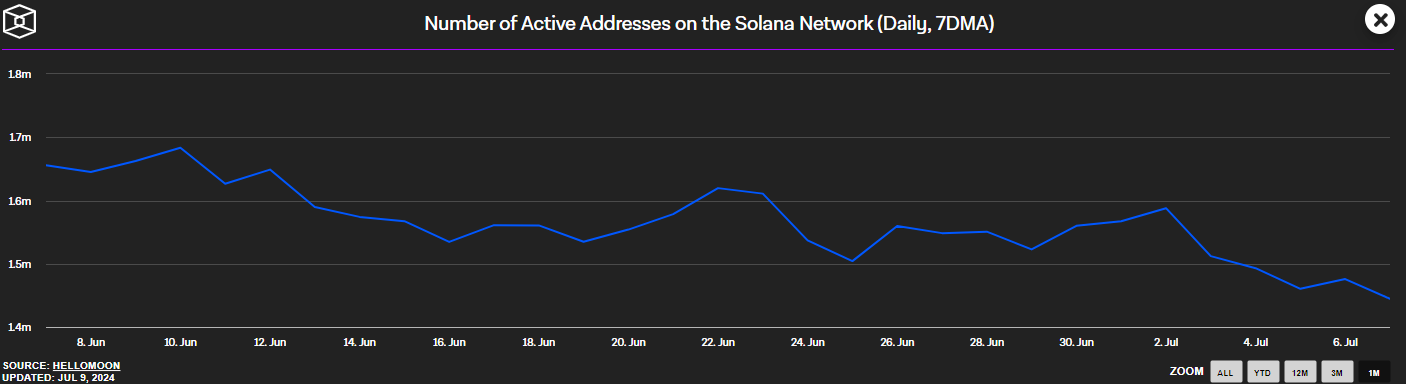

- Active Solana addresses dropped from 1.68 million to 1.44 million, indicating lower investor participation.

- Solana’s market cap rises to $65.952 billion, maintaining its position as the fifth-largest cryptocurrency.

In the past two days, the cryptocurrency market has seen considerable fluctuations, with Solana

Data from Coinglass shows that the Solana market has faced liquidations totaling more than $2.16 million, with an overwhelming $1.36 million coming from short positions at approximately the $141 mark. This suggests that numerous traders expecting a price decline were surprised by the rapid ascent to a daily peak of $143.68. Concurrently, the 24-hour trading volume for SOL increased by 9.12% to $3.17 billion, indicating heightened trading activity.

The unforeseen spike in activity compelled those who had bet against the market to close out their trades, which in turn exacerbated the market fluctuations. During this period of instability, the on-chain data for Solana indicates a worrisome pattern: a consistent drop in the count of active addresses, which reflects the recent downturn in the market.

The Number of Active Addresses on Solana Takes a Dive

The number of active addresses on Solana decreased from a weekly high of 1.68 million to a trough of 1.44 million. This downward movement encompasses 368,335 accounts with a Solana balance ranging from 1 to 10 SOL and another 117,910 accounts with 10 to 100 SOL holdings.

The reduction in the number of active addresses indicates a decrease in investor participation, which mirrors a heightened level of prudence in the prevailing market environment. This pattern may predict a further drop in Solana’s market value.

Amid ongoing market fluctuations, there is speculative expectation about the potential approval of a spot Ethereum ETF. If such approval is granted, it could act as a significant driver for the market, similar to the large inflow of capital seen with Bitcoin earlier in the year.

This event could trigger a surge of investments into the cryptocurrency space, considerably impacting Ethereum and possibly providing a lift to other cryptocurrencies such as Solana. The possibility has left traders and investors on the lookout, keenly awaiting the consequential changes that could reshape the market dynamics.

What Lies Ahead for Solana?

Solana has demonstrated its tenacity by recovering from a daily low of $135.27 to reach $141, reflecting a modest rise of 0.62% from the previous day, which may suggest the beginning of a recovery phase. As a result, Solana’s market capitalization has increased by 1.02% to $65.952 billion, affirming its status as the fifth-largest cryptocurrency by market cap.

Even with this increase, SOL remains in a downtrend. Its weekly and monthly charts show a 5% and 11% decrease, respectively. Should the present upward drive lose strength, SOL may drop to the support mark of $130, with the possibility of additional decreases to $119 and then to $110.

On the other hand, should the market sentiment turn more positive, SOL could break through the resistance levels at $153 and $161. Such a move might signal the beginning of a shift away from its current downtrend, providing a ray of hope for investors looking forward to a potential upswing in the short term.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.