This morning, Santiment (@santimentfeed) shared an interesting observation regarding Apecoin (APE). Despite its impressive breakout above $26 last year, the asset remained relatively under the radar in 2021. Unfortunately, many crypto traders have dismissed APE due to its price hovering around $4. Nonetheless, this insight highlights the potential for Apecoin to surprise the market in the future.

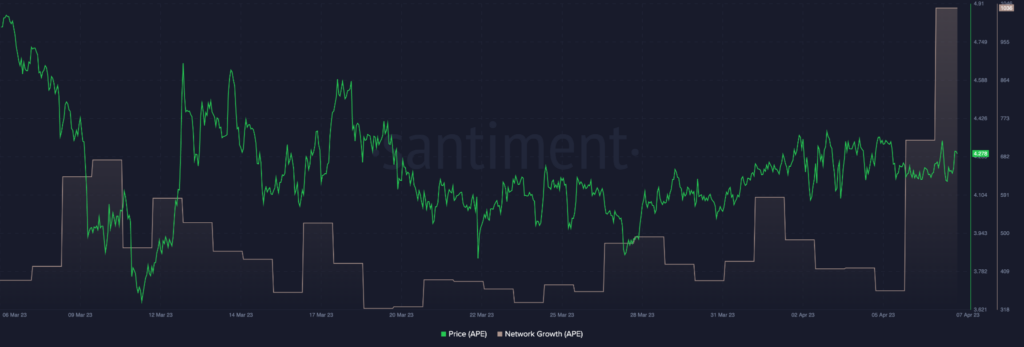

Santiment has released its latest Insights report on the crypto market, highlighting APE’s network’s noteworthy growth and address activity. This development is certainly worth keeping a close eye on.

The report highlights that heightened activity on a blockchain network can serve as a harbinger of future developments, irrespective of the market’s recent instability. In the case of APE, there has been a notable uptick in token holders’ balances, indicating a growing interest among retail investors. This trend could lead to a surge in APE’s price shortly.

Although the report acknowledged the heightened network activity for APE, it also emphasized the inherent unpredictability of the crypto market, making it impossible to guarantee a price surge.

As of the latest update, CoinMarketCap reports that APE is trading at $4.23, reflecting a 1.64% loss over the past 24 hours. Additionally, APE has experienced a slight dip of 1.92% against Bitcoin (BTC) and 1.69% against Ethereum (ETH). These figures indicate a potential shift in market dynamics, warranting close attention from investors and traders alike.

The trading volume of APE has witnessed a significant surge in the past 24 hours. Presently, this altcoin’s total daily trading volume stands at an impressive $97,912,041, marking a remarkable 43.63% increase from the previous day’s volume.

With a market cap of $1,561,736,887, the altcoin has secured its spot at number 38 on CoinMarketCap’s esteemed list of the largest cryptocurrency ventures based on market capitalization.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.