- Ethereum’s value declines against Bitcoin, 1 BTC now equals 18 ETH.

- ETH sees higher liquidations at $14.12 million, mostly from long positions.

- Technical indicators suggest potential downturn for ETH, possible BTC rise to $70,000.

The relationship between Bitcoin

Yet, the lackluster performance in the price of the altcoin has led to a situation where 1 BTC is now equivalent to 18 ETH. As of the latest update, Bitcoin’s value is $67,628, whereas ETH is $3,789. The divergent paths of these digital currencies are also evident in the trading market’s liquidations.

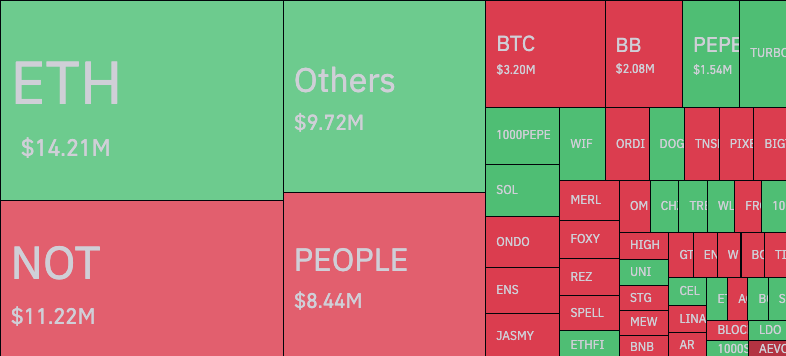

Data from Coinglass reveals that in the past 24 hours, ETH contracts worth $14.12 million have been liquidated, with the majority being long positions. On the other hand, Bitcoin saw a lower amount of liquidations at $3.20 million, with the bulk of them being short positions.

Coin Edition examined the ETH/BTC ratio, a significant indicator in the cryptocurrency market. Our analysis revealed that on May 21, the ratio peaked at 0.057, partly influenced by the approval of Ethereum spot ETFs.

Nonetheless, information from TradingView indicated a decline in Ethereum’s market dominance. At the time of this report, the value of ETH stood at 0.055 BTC. The chart analysis highlighted a previously encountered resistance level at 0.051, which Ethereum’s upward momentum has now surpassed.

Despite this breakthrough, there is a risk that a downward trend in Ethereum’s value could cause the ratio to retract to this resistance level. Should Ethereum fail to maintain above this threshold, the ratio might further slide to 0.048, where significant support is located.

Current readings from technical indicators such as the Awesome Oscillator (AO) suggest that Ethereum’s dominance might be waning. Presently, the AO is in the positive range, signaling a bullish momentum.

However, red bars on the histogram within the AO indicate that the bullish trend may be short-lived. Additionally, the Relative Strength Index (RSI) has shown a decline following its entry into an overbought territory.

Judging by current observations, there’s a possibility that the price of BTC may try to ascend to the $70,000 mark. Conversely, ETH may experience a downturn, indicating a potential drop to $3,500.

Conversely, the situation could shift positively for ETH with the commencement of spot ETF trading. Reflecting on Bitcoin spot ETFs’ effect on BTC’s value, it’s conceivable that ETH could surge to $4,500 within a few weeks.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.