- Investor 0x2ce moves 4,153 ETH to Coinbase, worth $12.2 million.

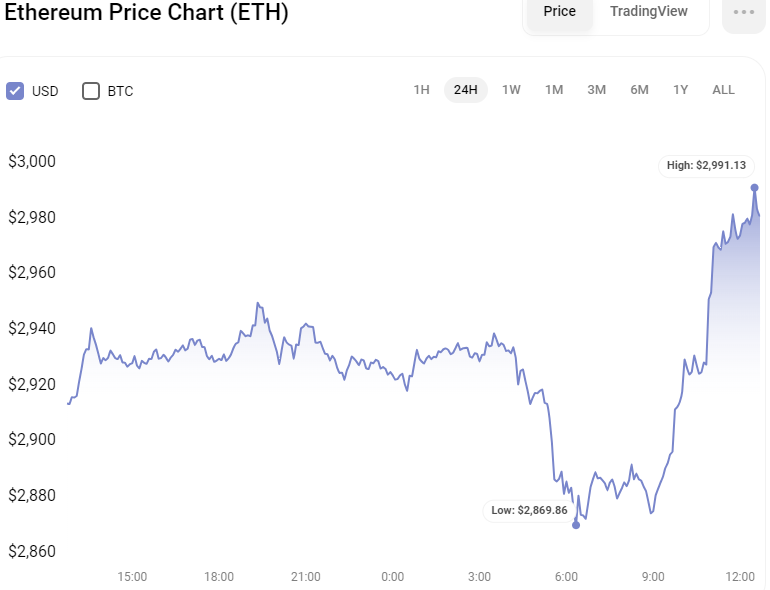

- ETH price rises to $2,980.71, with a 2.27% increase.

- ETH token shows bullish signs, with potential for price breakout.

A perceptive individual known by the wallet address 0x2ce, who was among the first to embrace Ethereum

Additionally, back in 2016, the same whale withdrew 12,423 ETH from the Poloniex exchange when the price was approximately $11.03 per ETH, resulting in a total of around $137,000. This initial acquisition of Ethereum has since produced remarkable profits over the years that followed.

From 2021 onwards, the investor has moved 9,436 ETH to both Coinbase and Luno exchanges at an average price of $2,245 per ETH, which equates to $21.2 million. The whale’s Ethereum balance currently stands at 2,566 ETH, valued at an estimated $7.48 million.

According to the report, the anticipated total earnings from these transactions are about $28.5 million, signifying a 204% increase in value from the original investment.

ETH Market Performance

At the time of reporting, the price of ETH is $2,980.71, showing a 2.27% rise since the previous day. In addition, the daily market capitalization has risen by 1.90%, reaching a total of $357,626,638,421. This growth in market capitalization reflects the growing interest and investment in Ethereum.

Moreover, the trading volume of ETH has increased significantly by 67.91%, reaching a total of $10,196,235,638. This surge in trading volume indicates a heightened level of investor interest and activity. The rising trading volume, along with the increase in the price of the token, points to a positive sentiment among investors.

ETH Token: Bullish or Bearish?

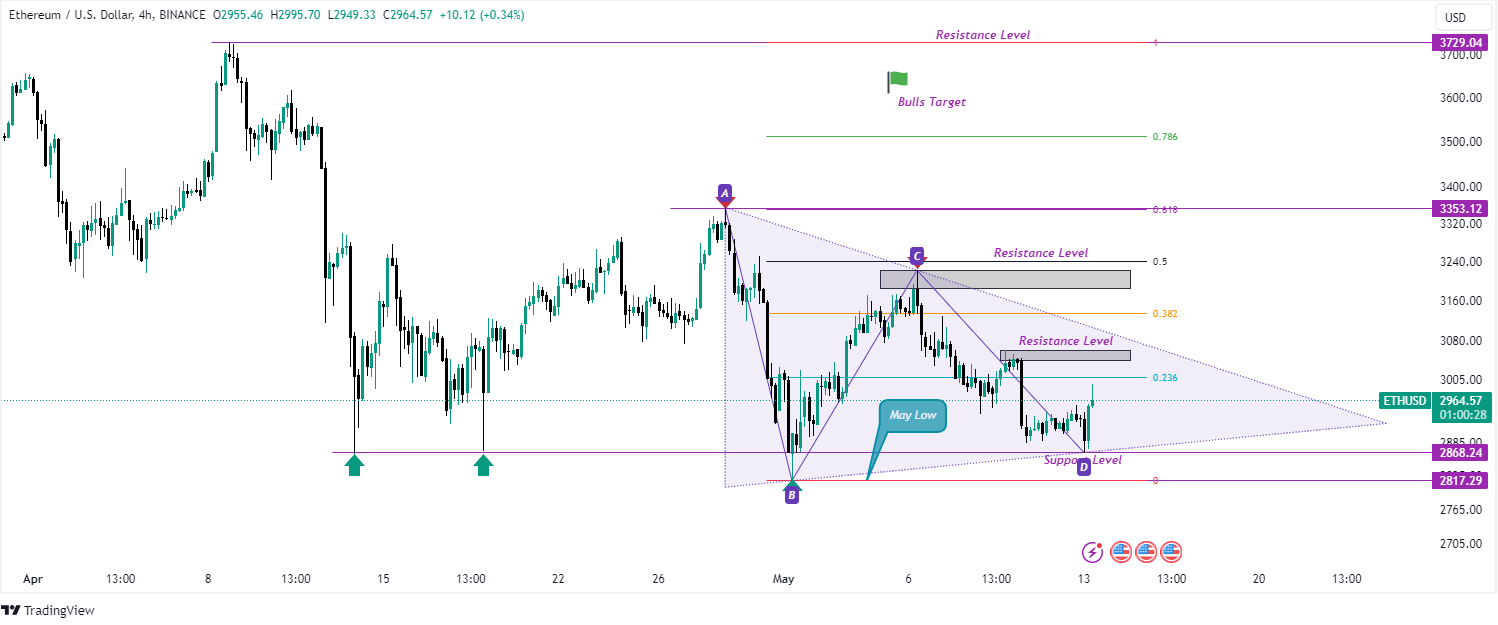

Currently, the ETH token is exhibiting a symmetrical triangle pattern on the 4-hour chart, with the price fluctuating between $3,353.12 and $2,817.29. This pattern suggests that the price of the ETH token is undergoing a period of consolidation within a converging range, setting the stage for a possible breakout in one direction or the other.

If the positive trend continues, the ETH token may begin to climb, aiming for the initial resistance point at $3,061.77. The objective is to attain the significant resistance mark near the 50% Fibonacci retracement level. If successful, this effort might drive ETH prices to greater heights, with the next goal being the 61.8% Fibonacci retracement level, which coincides with the objectives of bullish investors.

On the other hand, should the ETH token face downward pressure, it is anticipated to encounter support at $2868.24 before making another attempt to rise. Should this support level be breached, it could trigger additional price drops, with the possibility of the price descending to the $2817.29 support level, last reached on May 1.

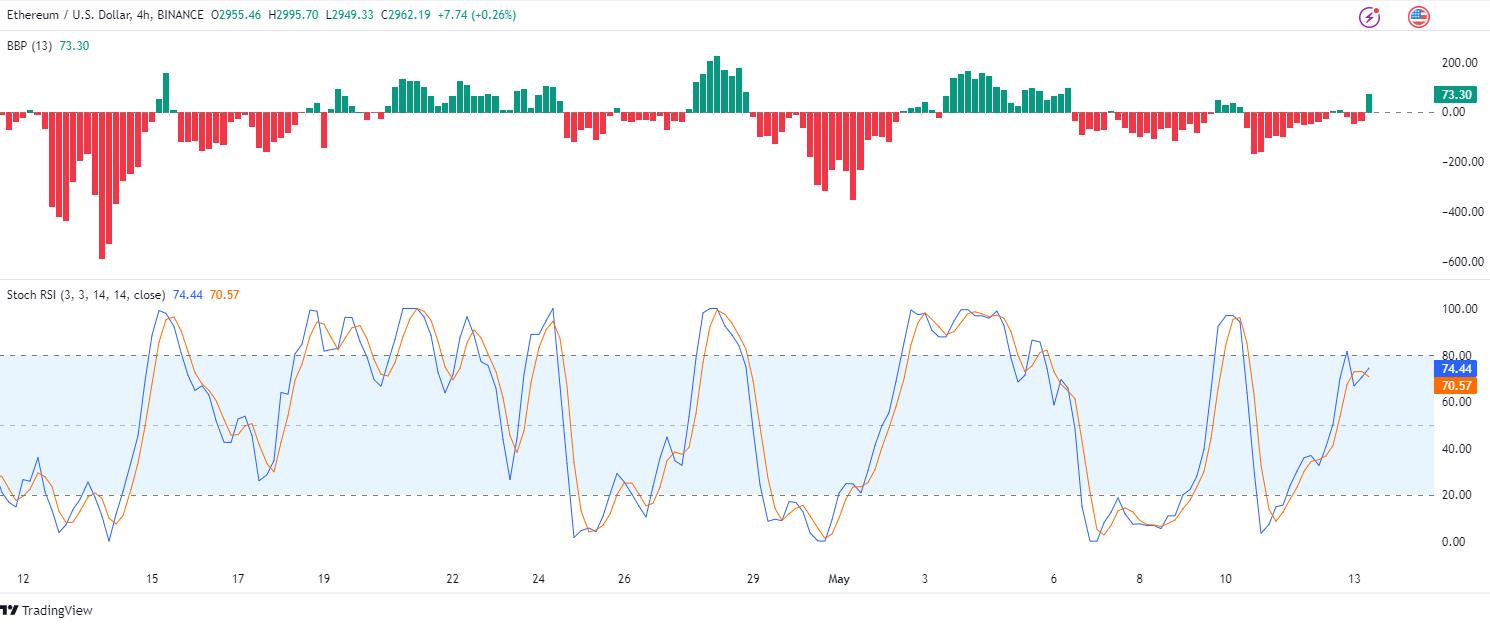

Technically, the Bull Bear Power indicator displays a green bar surpassing the zero line, located at 73.30. This indicates a strengthening of bullish momentum for the ETH token shortly, indicating that prices could continue to rise if this momentum is maintained.

Additionally, the stochastic RSI is positioned close to the overbought territory, indicating a possible near-term reversal for the ETH token. Nonetheless, the K line (blue) ascending above the signal line indicates the potential for further increases prior to any likely correction.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.