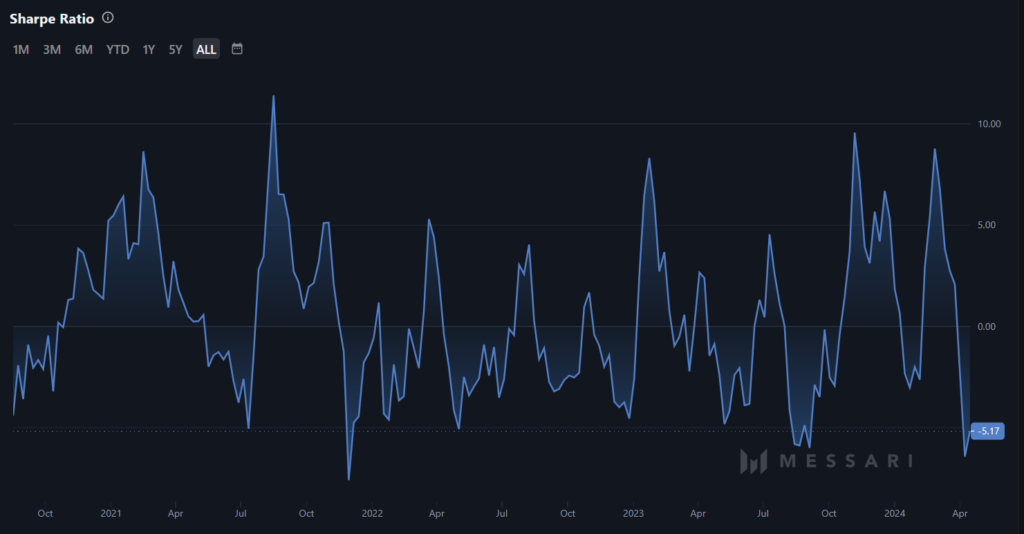

- Polkadot’s Sharpe Ratio at -5.17 indicates poor risk-adjusted performance.

- Investor withdrawals from futures market suggest declining confidence in DOT.

- Polkadot price risks falling below $6.3, could test new lows.

Polkadot

A critical measure that points to Polkadot’s difficulties in drawing investors is the Sharpe Ratio. This metric evaluates the risk-adjusted performance of an investment or portfolio.

At present, the Sharpe Ratio for Polkadot is alarmingly at -5.17, which signals a deficiency in robust risk-adjusted performance. This negative value acts as a repellent for prospective investors, who typically look for investments that present a positive balance between risk and return.

The Sharpe Ratio, at its lowest in seven months, highlights the hurdles Polkadot is facing as it seeks to regain its value. A negative Sharpe Ratio implies that the asset’s returns have not been satisfactory relative to the risks it carries, rendering it an unattractive option for investors who prioritize effective investment approaches.

The Future Path for Polkadot:

Maintaining the engagement of existing DOT investors is just as important as drawing in new ones for the potential recovery of Polkadot. Nonetheless, current trends indicate that the platform is losing traction, evidenced by investors withdrawing funds from the futures market. This outflow of funds from the futures market may be indicative of waning investor confidence and an increased likelihood of further declines in price.

Polkadot is facing a significant obstacle in its path to price recovery due to the unappealing risk-reward ratio and a decrease in interest in the futures market. With its price at $6.6, the cryptocurrency has seen a considerable downturn after negating a falling wedge pattern, which makes it susceptible to further downward trends.

Experts in the market caution that a drop below the crucial support level at $6.3 could lead to a steeper fall in Polkadot’s price, possibly down to $5.7, a low not seen in four months that could set a new floor for 2024. Nonetheless, the established support at $6.3 could also lead to a rebound, potentially driving the price of DOT above $7.00 and reviving upward momentum.

In the face of these difficult market conditions, Polkadot’s success in restoring investor trust and securing new investment will be pivotal in shaping its path forward.

Polkadot faces a tough task in reasserting itself as an attractive investment option in the highly competitive crypto market, whether it does so by improving the risk-reward ratio or by stimulating renewed interest in the futures market.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.