- Digital asset investments exceed $1.1 billion with Bitcoin ETFs launch in U.S.

- Grayscale faces $414 million outflow; BlackRock Bitcoin ETF attracts $693 million.

- Bitcoin price surpasses $48,000 following Spot Bitcoin ETF introduction, then slightly retreats.

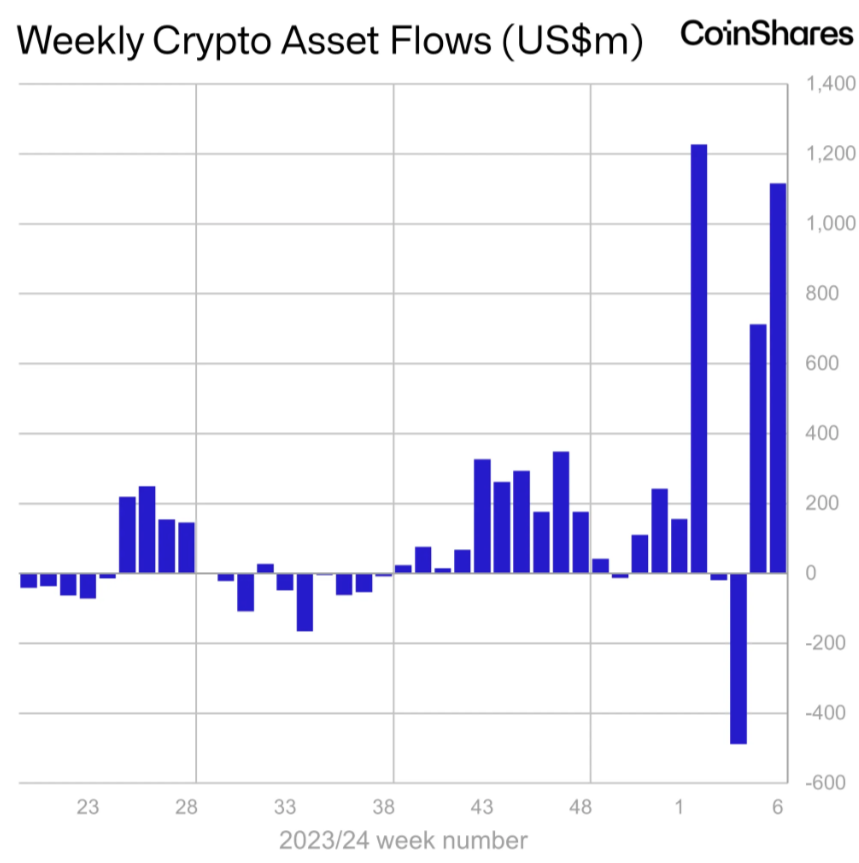

Digital asset investment products saw an influx of over $1 billion last week, marking a significant increase. According to the most recent report from CoinShares, these products attracted inflows exceeding $1.1 billion in the same period.

The rise in incoming funds corresponds with the introduction of physical Bitcoin ETFs in the U.S., which has captured interest. It’s worth mentioning that Grayscale experienced a weekly deficit of $414 million despite the significant withdrawal. Conversely, the Bitcoin ETF offered by BlackRock is prominent, attracting more than $693 million in inflows.

The introduction of Spot Bitcoin ETFs on January 11th resulted in inflows reaching $2.8 billion. In the previous week, the rate of outflows from Grayscale diminished, although outflows from Grayscale continued. CoinShares remarked that the prospective sale of Genesis assets valued at $1.6 billion might cause further outflows in the future months.

In terms of geographical regions, outflows impacted Canada and Germany, with losses amounting to $17 million and $10 million, respectively, whereas Switzerland experienced an inflow amounting to $35 million in the previous week.

Bitcoin

Following the introduction of spot Bitcoin ETFs, Bitcoin’s price initially remained static, but at the conclusion of the previous week, it underwent a notable increase, indicating a revival. This rebound effectively elevated the price of BTC beyond the $48,000 threshold, signaling a cessation of the period of minimal price fluctuations.

Despite the recent increase, Bitcoin’s value decelerated on Monday, falling beneath $48,000. BTC’s trading price is $47,920, reflecting a 1% decrease over the past 24 hours. The trading volume remains over $20 billion, marking a 7% rise.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.