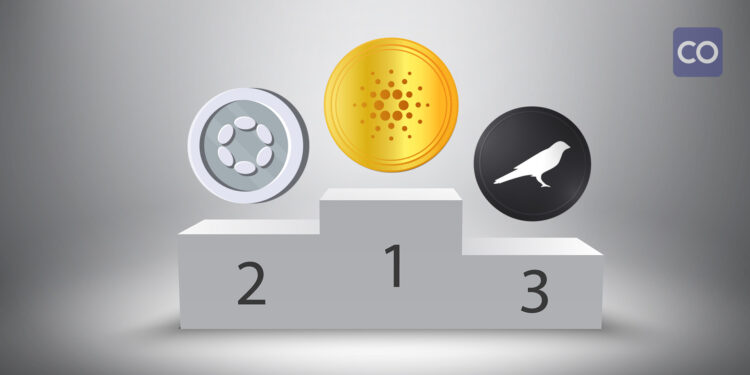

- Cardano (ADA) leads in development activity over Polkadot (DOT) and Kusama (KSM).

- ADA’s value drops by 24.93% despite high development activity.

- ADA’s technical indicators suggest potential further price decline.

Over the past month, Cardano

The metric of development activity on a blockchain is represented by a project’s linked public GitHub repositories. An increase in this metric signifies that the project has released additional features on its network.

Nonetheless, a reduction in development activity indicates a decline in developers’ code commits.

On numerous occasions, Polkadot and Kusama have been at the forefront of this ranking. Therefore, occupying the second and third spots with Cardano in the lead indicates that developers’ dedication to the network has diminished compared to what it once was.

Generally, increased development activity might be considered a positive indicator for a project. However, this did not hold for the native token of Cardano. In the past 30 days, ADA has experienced a 24.93% decrease in its value due to heightened selling pressure.

Market’s Sell Signal Detected

As of the reporting time, the token’s value stood at $0.46. Upon examining the 4-hour chart’s Supertrend indicator, Coin Edition observed that ADA had finished beneath it. This indicates that the 5-day Exponential Moving Average had dropped beneath the 20-day Exponential Moving Average.

The role is viewed as an indicator to sell, suggesting that the price of ADA is expected to keep declining. Should the bulls fail to maintain the support level at $0.43, it’s possible that an additional correction of 15% might occur, potentially bringing ADA’s price to $0.38.

Additionally, the Relative Strength Index (RSI) indicated a lack of purchasing interest. At the moment of this report, the RSI stood at 25.03, suggesting that ADA was in an oversold condition and the likelihood of a rebound to higher prices was significantly diminished.

Upon the RSI reaching 30.00, buyers would have been expected to try and challenge the resistance level at $0.50. However, as this did not occur, an additional decline is possible.

Regarding the Funding Rate, data from Coinglass indicated that this measure had remained unchanged for a period. The Funding Rate represents the expense associated with maintaining an open perpetual contract in the derivatives market.

The Funding Rate for ADA ensured that the gap between the perpetual contract price and the spot market price remained narrow.

From the trading viewpoint, the stagnating Funding Rate indicates that both shorts and longs are not taking assertive positions. Therefore, ADA might either undergo a period of consolidation or persist in its price correction.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.