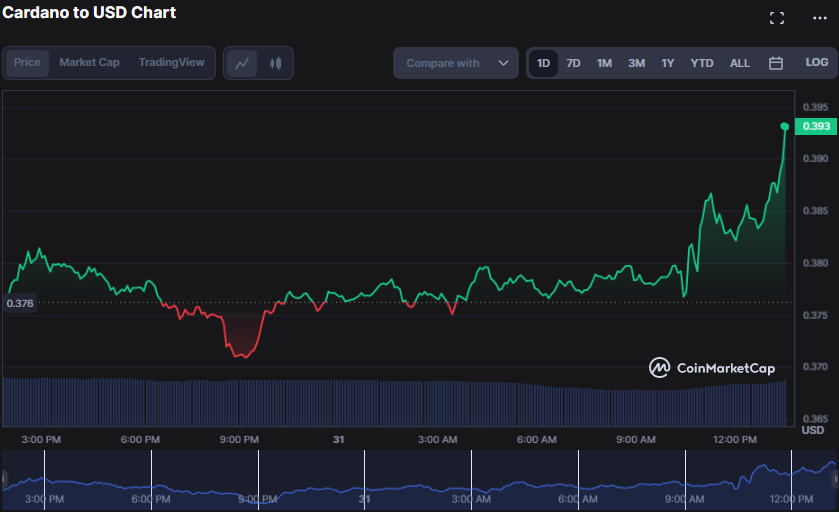

Despite the bear’s valiant efforts to defy the trend, Cardano (ADA) bulls have emerged as the dominant force in the market over the past 24 hours. During this bullish run, the support and resistance levels were $0.3709 and $0.39, representing the “buy” and “sell” zones, respectively. The bullish momentum remains robust, with ADA trading at $0.3898, reflecting a 3.03% increase and indicating the potential for further upward movement. These developments suggest that ADA is a promising investment opportunity for those seeking to capitalize on the current market conditions.

Should the current bullish momentum persist and successfully breach the $0.39 resistance, ADA’s value may experience a surge with potential resistance levels at $0.40 and $0.42. This could attract more buyers and further bolster the cryptocurrency’s value. Conversely, if the bears take over, the support levels at $0.3709 and $0.35 may come into play. Keep a watchful eye on these levels as they could impact ADA’s market performance.

The market capitalization has experienced a 3.25% increase, reaching an impressive $13,571,695,638. However, the 24-hour trading volume has decreased by 4.36%, settling at $396,835,225. This shift indicates a potential slowdown in bullish momentum and a possible period of consolidation before the next significant market shift.

The trend in ADA is poised to persist, with the Bollinger bands expanding as the market heads toward the north. This development indicates that investors may want to contemplate putting their money into ADA in anticipation of further price surges. The upper bar reaches 0.399, while the lower bar touches 0.353, underscoring the bullish momentum.

Based on the Aroon up reading of 100.00% and the Aroon down the reading of 71.43%, it appears that ADA is currently experiencing a robust uptrend with sustained purchasing pressure. While this is certainly encouraging news for traders, it’s important to exercise caution and implement stop-loss orders to safeguard against sudden market fluctuations that could lead to a price drop.

The Chaikin Money Flow (CMF) has indicated a positive trend for ADA, with a reading of 0.46. This suggests that the market is experiencing an influx of funds, which may lead to a continuation of the bullish momentum. As a result, traders are gaining confidence in the ADA market, and this could attract more investors to join the trend, potentially driving up the price even further. This is a positive sign for ADA and may allow investors to capitalize on the upward trend.

The Fisher Transform reading of 0.52, coupled with its upward movement above the signal line, strongly confirms the bullish sentiment currently in the ADA market. This presents a promising buying opportunity for traders seeking to capitalize on the upward trend.

If the signal line is breached, a potential shift toward bearish sentiment may be inferred, prompting traders to consider securing gains or minimizing losses.

The ADA bulls have exhibited remarkable strength, surging past the resistance levels. As traders navigate this bullish momentum, it is prudent to employ stop-loss orders and remain vigilant for any potential market swings. Stay alert and stay ahead of the game.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.