- Whale transfers $20.98 million in XRP from MEXC exchange to private wallet.

- XRP’s price stabilizes at $0.56, down 10.25% over the past week.

- XRP’s Open Interest drops to $476.53 million, indicating potential downward movement.

The Whale Alert X account reported that on December 10, a whale transferred $20.98 million worth of Ripple

At the time of reporting, XRP’s trading price was $0.56, having experienced a decline of 10.25% over the past week. Although its recent performance has not been impressive, the significant transfer of XRP from the MEXC exchange to a private wallet indicates that at least one major investor believes in the future prospects of XRP.

Buyers Demonstrate Absolute Weakness

Examining the XRP/USD chart with a 4-hour timeframe, it is evident that since January 3, the digital currency has been fluctuating within a narrow range, specifically from $0.55 to $0.58. Coin Edition reviewed the Relative Strength Index (RSI) on the chart and remarked on the sluggish pace of purchasing momentum.

At the time of this report, the Relative Strength Index (RSI) stood at 45.57. The pattern displayed by the indicator lately indicates that purchasers have attempted to drive the price of XRP higher, yet these efforts have not resulted in a lasting upward movement.

One factor contributing to the cryptocurrency’s failure is the inability to retest the $0.60 region. Should buying interest not pick up shortly, XRP’s price could fall to the $0.55 support level.

Examining the Chaikin Money Flow (CMF) revealed that the indicator had decreased to -0.02. The CMF is used to assess the levels of buying and selling pressure over a specific time frame. A positive reading on this indicator would suggest that there is a rise in buying pressure for XRP.

Nevertheless, the negative indication from the CMF revealed that selling pressure was predominant. If the value continues to decline into the negative territory, there is a risk that XRP could descend below the support level of $0.55.

XRP Price May Dip from Liquidations

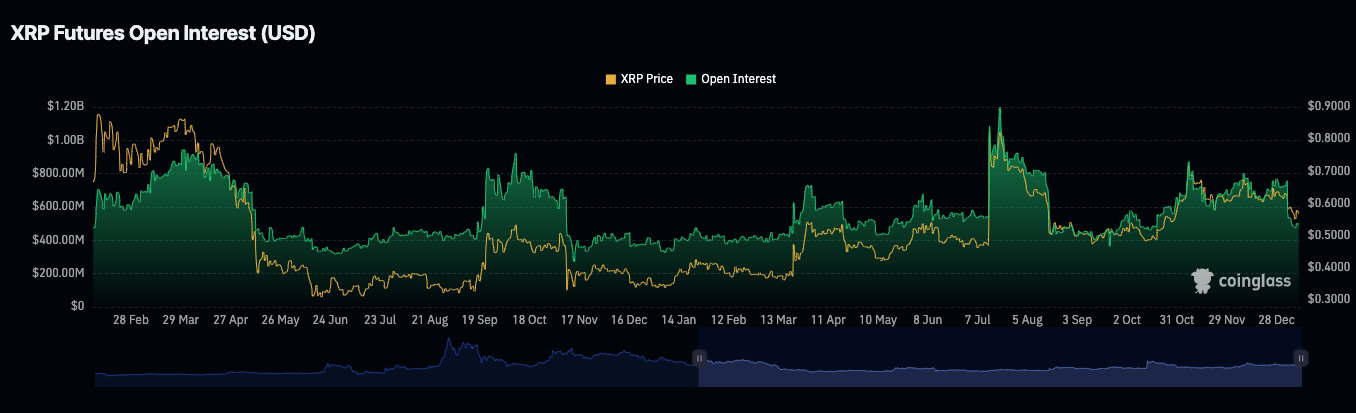

According to Coinglass data, similar to the price movement, there has been a significant drop in XRP’s Open Interest (OI). As of the latest update, the OI has decreased to $476.53 million.

Open Interest denotes the total number of open contracts. It fluctuates, going up or down, according to the net positions. An increase in Open Interest indicates that market participants are adding to their net positions.

Conversely, a reduction indicates a rise in the number of closed positions. Regarding the price of XRP, the diminished Open Interest points to an absence of momentum for a potential upward movement.

Consequently, it seems more probable that XRP will move downward to its support level of $0.55 rather than ascend to the nearby resistance level of $0.58.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.