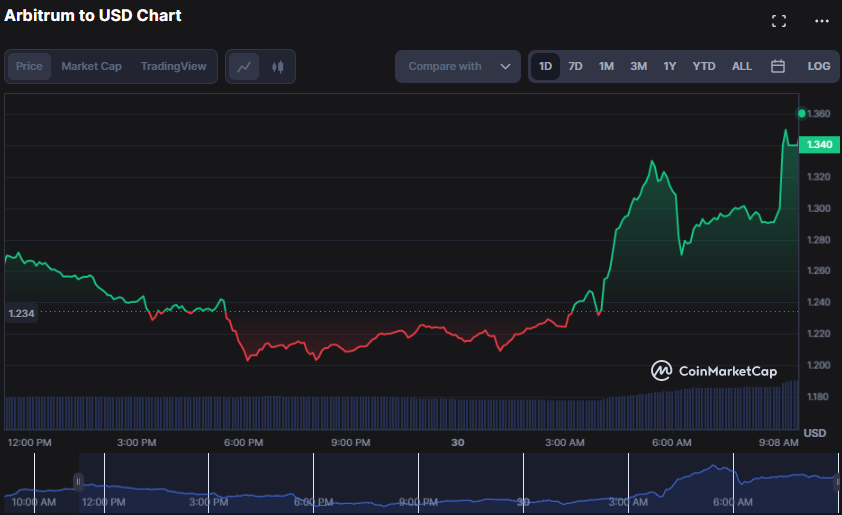

The Arbitrum (ARB) market kicked off the day with a bullish surge, only to experience a brief setback that caused the price to dip to a 24-hour low of $1.20. However, the Bulls quickly regained their footing and pushed past the negative momentum, rallying the ARB price to a 24-hour high of $1.36 after hitting the support level of $1.20. Overall, the market displayed resilience and a strong bullish sentiment, indicating the potential for further growth.

Should the bulls continue to dominate and successfully breach the resistance at $1.36, keep an eye on potential resistance levels hovering around $1.40 and $1.45. Conversely, if the bears regain control, it is important to monitor support levels at $1.30 and $1.25. ARB is currently valued at $1.34, exhibiting a robust bullish momentum with a 7.05% increase from its previous close.

The market capitalization and 24-hour trading volume have experienced a notable surge, with a 6.80% and 62.27% increase, respectively. The current figures stand at an impressive $1,710,838,510 and $1,339,229,852. This upward trend is attributed to anticipating the release of over 1.6 million ARB tokens, which is expected to solidify the relationship between Arbitrum and Stargate further.

The ARB/USD price chart reveals a promising trend as the Keltner Channel bands rise. The upper bar stands at 8.67 while the lower one is at 7.80, indicating a bullish market gaining momentum. This movement suggests that the price may continue to surge within the confines of the upper and lower Keltner Channel bands. These developments are worth monitoring closely for potential investment opportunities.

Despite the current formation of red candlesticks and the price action shifting toward the middle band, traders must remain vigilant and closely monitor the support levels. This will enable them to determine whether the trend will persist or reverse shortly. As such, a pullback may be imminent, and traders must exercise caution and make informed decisions based on the available data.

The Stochastic RSI has taken a dip below its signal line, indicating a decline in ARB bullishness with a score of 72.29. As a precautionary measure, traders are advised to consider implementing a stop-loss strategy or taking profits to secure their gains in the event of a trend reversal. It’s always wise to stay vigilant and protect your investments.

According to the Chaikin Money Flow level of 0.15, ARB’s bullish momentum is currently lacking strength, with minimal buying demand to drive the price forward. This could indicate an upcoming trend shift or a period of price stability.

As it journeys southward, it serves as a harbinger of potential downturns, indicating a possible price dip or a shift in market sentiment toward selling.

Based on the current Coppock Curve reading of 13.56, the bullish trend may have hit its apex. As a result, investors are advised to exercise caution and consider implementing risk management strategies or taking profits to safeguard their investments.

As the ARB/USD price continues to climb, bullish traders have set their sights on the $1.40 and $1.45 resistance levels. However, it’s important to exercise caution as indicators suggest the potential for a trend reversal. As always, it’s crucial to approach the market with a professional mindset and carefully consider all factors before making any investment decisions.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.