- BNB Coin shows an 8% increase, potentially entering a sustained rise.

- AVAX faces volatility, seeks stability above Macro Downtrend for growth.

- MATIC breaks resistance, enters expansion with a 37% price surge.

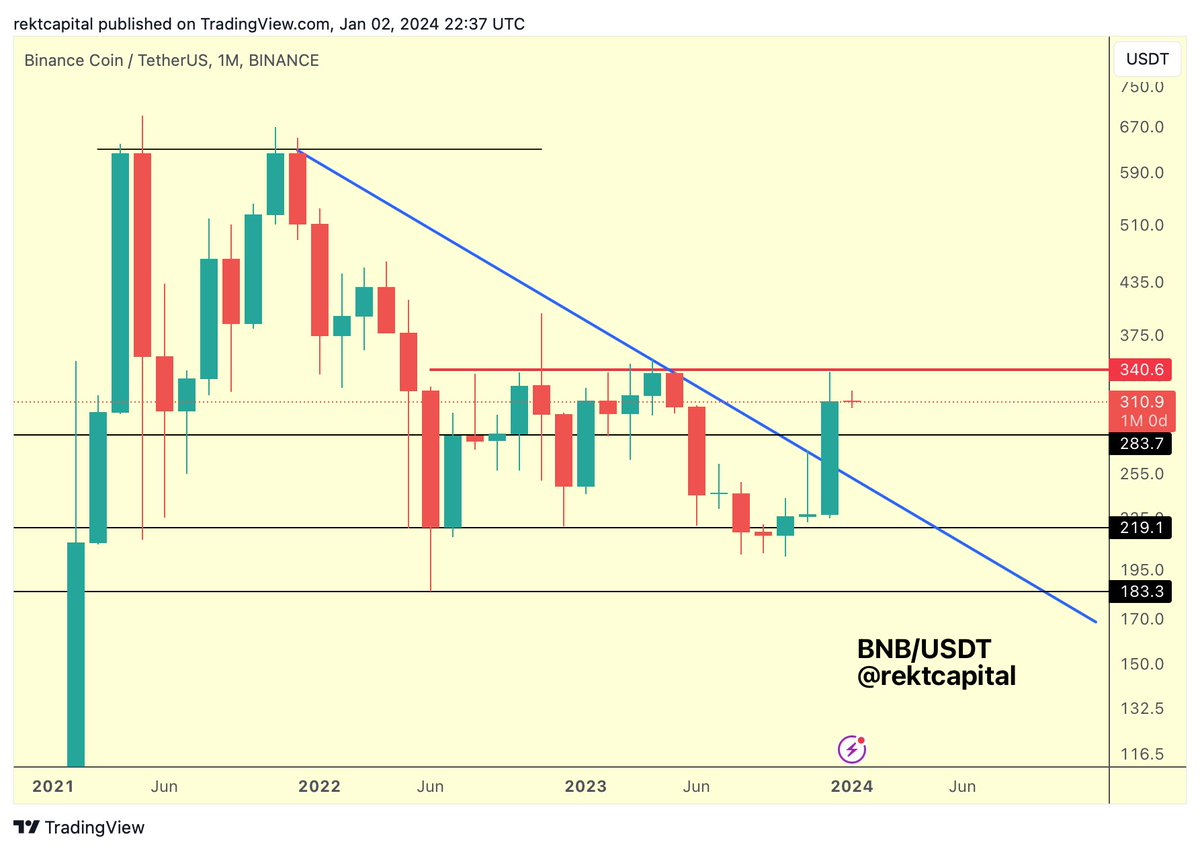

On X (previously known as Twitter), cryptocurrency analyst Rekt Capital shared multiple forecasts regarding the future value of prominent alternative cryptocurrencies such as Binance Coin

BNB Coin

Rekt Capital states that BNB Coin, presently valued at $318.95, may be experiencing a sustained upward trajectory. Recent data from CoinMarketCap indicates that BNB’s value has increased by 8% over the past week, following a slight uptick in demand.

Following its encounter with temporary downward pressure at the resistance level of $340, the crypto asset ranked fourth experienced this.

Nonetheless, the cost may stabilize within a certain interval before a continuous increase occurs.

BNB may be forming a new range here (black-red). In no man’s land, between black Range Low support ($283) and red Range High resistance ($340), ” the analyst opined.

Avalanche (AVAX)

Rekt Capital observed that AVAX revisited its enduring downward trend line, leading to a 36% increase in value.

Nevertheless, a decline succeeded this surge, which has currently returned AVAX to the retest area.

At this stage, the coin attempts to maintain stability above its ultimate Macro Downtrend to confirm ongoing momentum. Should this be achieved, it may set the stage for additional increases.

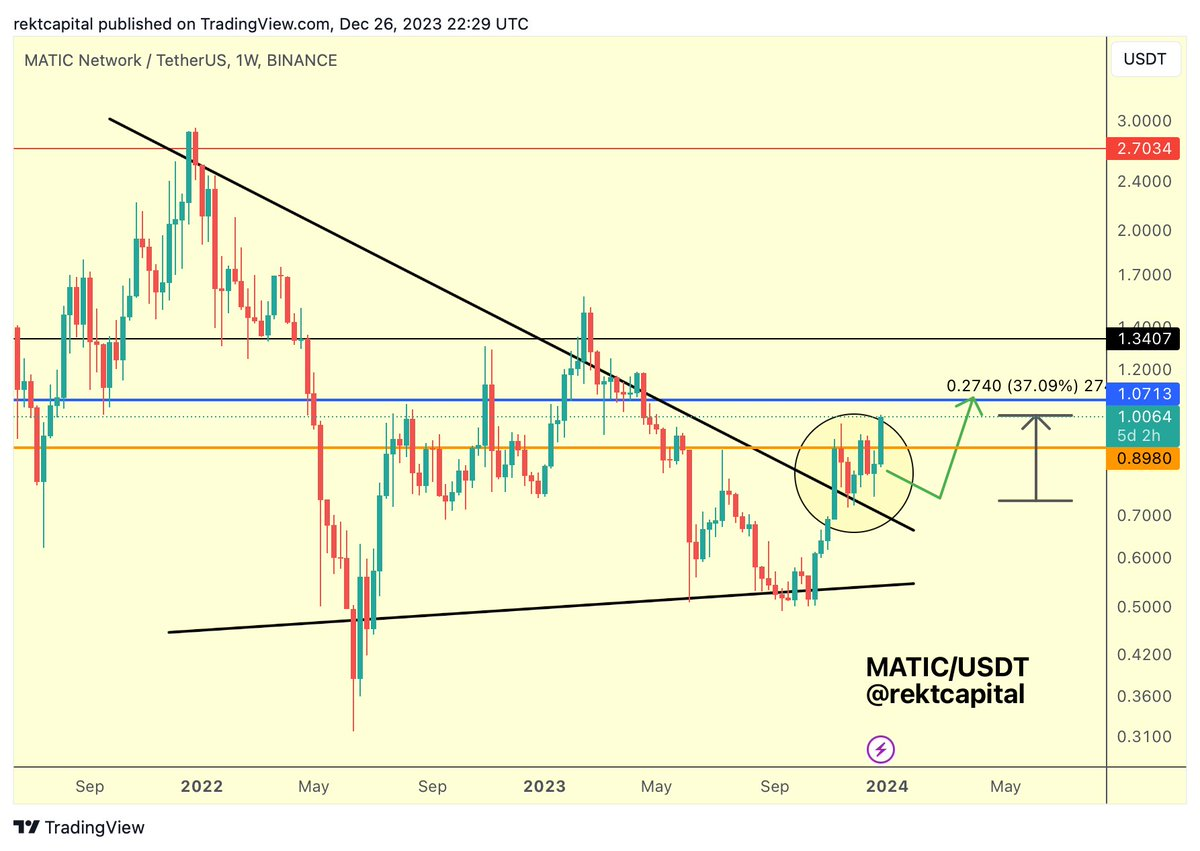

Polygon (MATIC)

At this stage, MATIC has surpassed an important resistance threshold and has begun a new period of expansion. Following this resistance retest, the price of the alternative cryptocurrency has risen by 37%, tracing a distinct upward trajectory.

According to CoinMarketCap, MATIC was trading at $0.98 at the time of this writing.

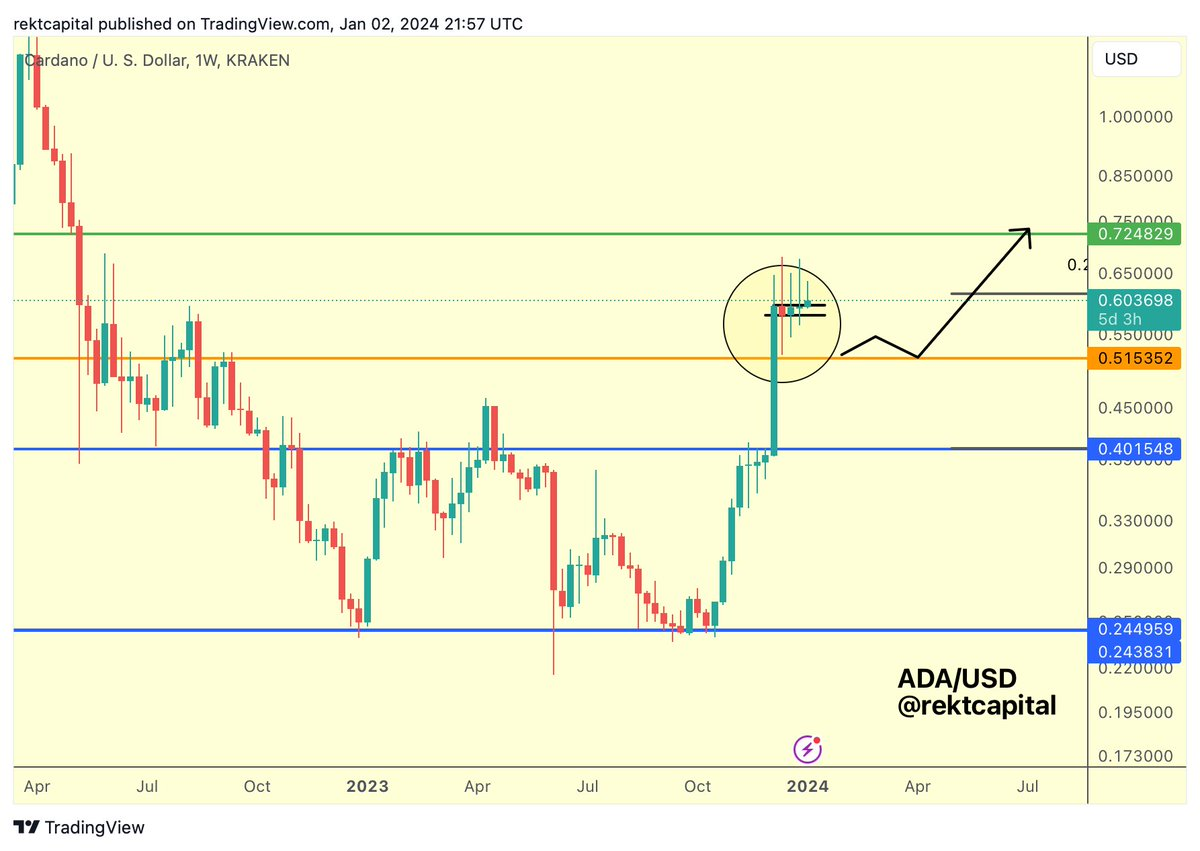

Cardano (ADA)

The analyst pointed out that ADA’s price fluctuations indicate that the cryptocurrency has established a fresh trading band, in which it has been fluctuating within a certain price corridor.

This lateral shift might be seen as a re-accumulation phase, during which purchasers gradually increase their positions in anticipation of a possible breakout.

Rekt Capital observed that the present price of ADA is lingering near the peak of the range, which once served as a barrier. Should ADA manage to break through and maintain this level as a foundation, it might indicate a potent cue for continued ascension.

Chainlink (LINK)

Regarding LINK, Rekt Capital observed that the token remains in a trading range. The “Blue Structure” referred to by the analyst in the accompanying chart indicates that the price of LINK consistently encounters resistance at the top of the channel and finds support at the bottom.

This implies that both purchasers and vendors are at ease within this interval, with neither party possessing sufficient strength to breach the set limits conclusively.

Nevertheless, within the Blue Structure, there is a “Red Area” that the token’s price has often returned to previously. If this pattern continues, this region could provide support or resistance.

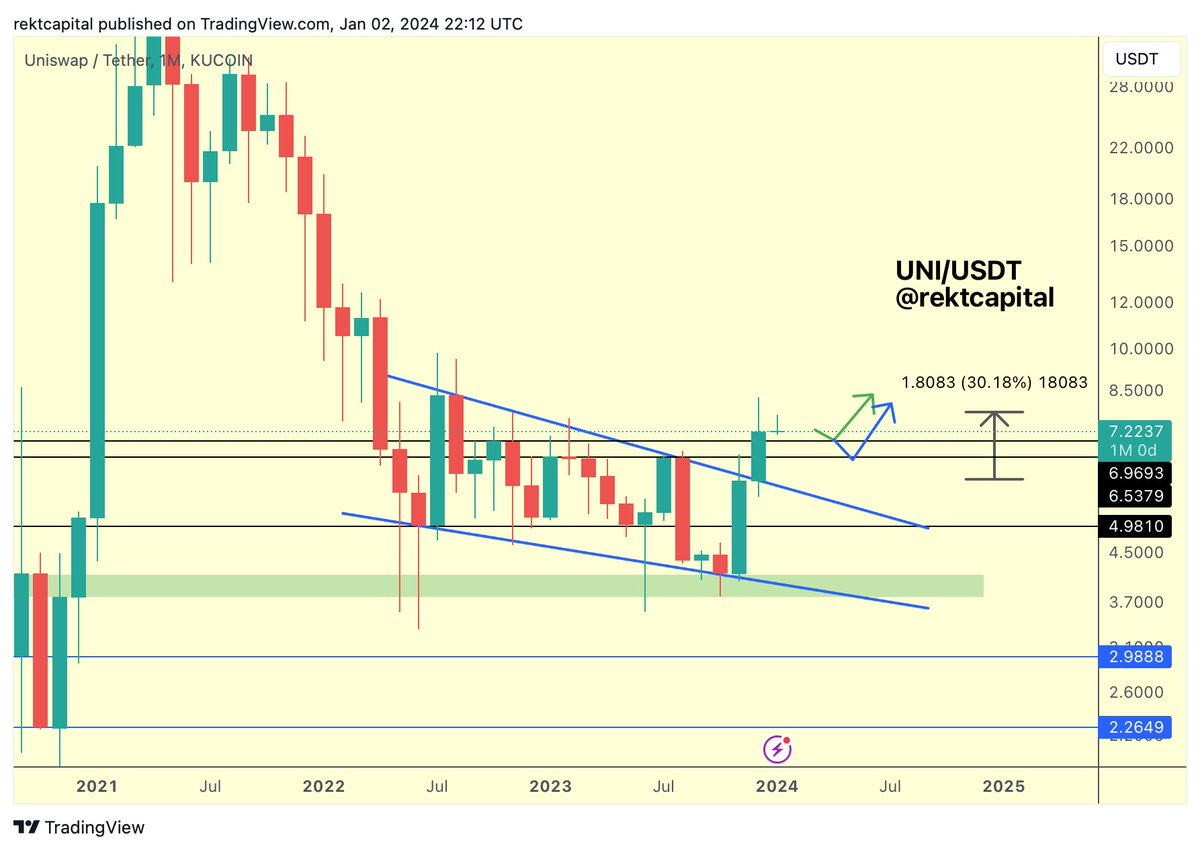

Uniswap (UNI)

Following an escape from a larger upward trend, the price of UNI has experienced a decrease. Having reached a high of $8.2 on December 28, the value of the alternative cryptocurrency has dropped by 10%. Currently, as per the information from CoinMarketCap, it is trading at $7.34.

Rekt Capital has observed that the present decline is aiming for two possible support levels at $6.96 and $6.53, following which there could be an upward trend.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.