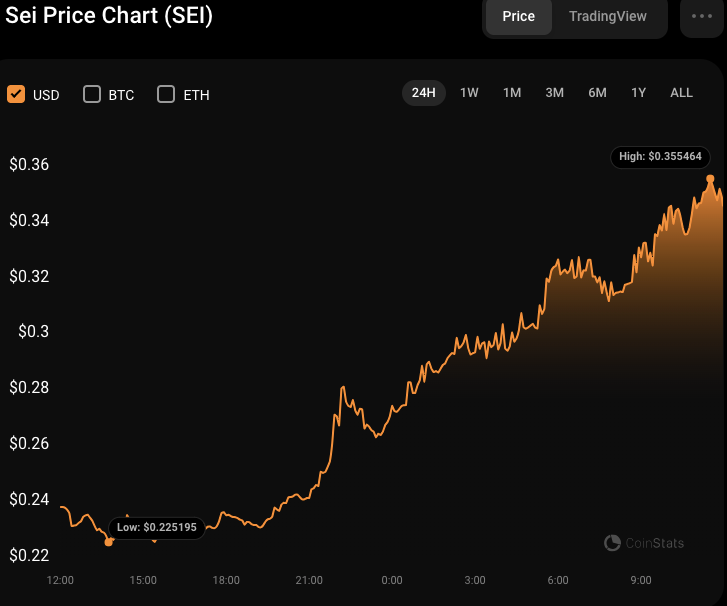

- Sei (SEI) price surges 50%, reaching new ATH of $0.355464.

- Sei’s trading volume spikes 413%, leading gains among top 100 cryptocurrencies.

- Sei’s market cap now $772 million, ranked 79th in market size.

Over the past 24 hours, the Sei

Trading Volume Soars Amidst Rising Social Buzz

Furthermore, the trading volume of Sei has experienced a substantial increase of 413% in the last 24 hours, amounting to $725,373,521. This rise has positioned SEI as the leading 24-hour performer in terms of gains among the top 100 cryptocurrencies, as reported by CoinMarketCap. In addition to its monetary expansion, there has been a significant rise in social volume, evidenced by a 154% growth in the number of discussions surrounding Sei, with the majority of this chatter occurring on platforms such as Telegram and X.

Additionally, the total open interest (OI) for SEI has experienced a 123% surge, escalating from $33.8 million to $75.4 million within a single day. Nonetheless, how this open interest is allocated between long and short positions in the market is yet to be determined.

The price increase can be traced back to the recent news from last month about a collaboration between Circle, the company responsible for USDC, the second biggest stablecoin, and Sei, a layer-1 blockchain. Subsequently, Sei Labs announced that the second version of Sei would include compatibility with the Ethereum Virtual Machine. These significant events played a key role in the SEI token achieving its former all-time high of $0.295 in November.

SEI/USD Technical Analysis

On the SEI/USD price chart, the Chaikin Money Flow (CMF) is exhibiting an upward trend with a value of 0.37, signifying a buying pressure present in the market for SEI/USD. This trend suggests that the volume of capital entering the cryptocurrency exceeds the volume exiting, potentially leading to a rise in its price.

Additionally, a favorable CMF rating suggests that investors have a bullish outlook on the SEI/USD and are in the process of building up their holdings. Should the CMF rating increase more, it might indicate an even more robust upward trend for the SEI/USD.

The stochastic RSI figure, which is at 77.08 for SEI/USD, suggests that SEI is presently in an overbought condition. Consequently, this situation could lead to a temporary price adjustment or stabilization period as traders start to realize their gains. Should the stochastic RSI measure stay elevated or increase further, it could lead to an additional downturn or pullback in the price of SEI/USD.

Sei (SEI) has significantly increased, surpassing its highest historical value. There is a rise in both trading activity and social interaction, indicating a robust upward trend, yet it is recommended to be wary because the asset may be excessively purchased.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.