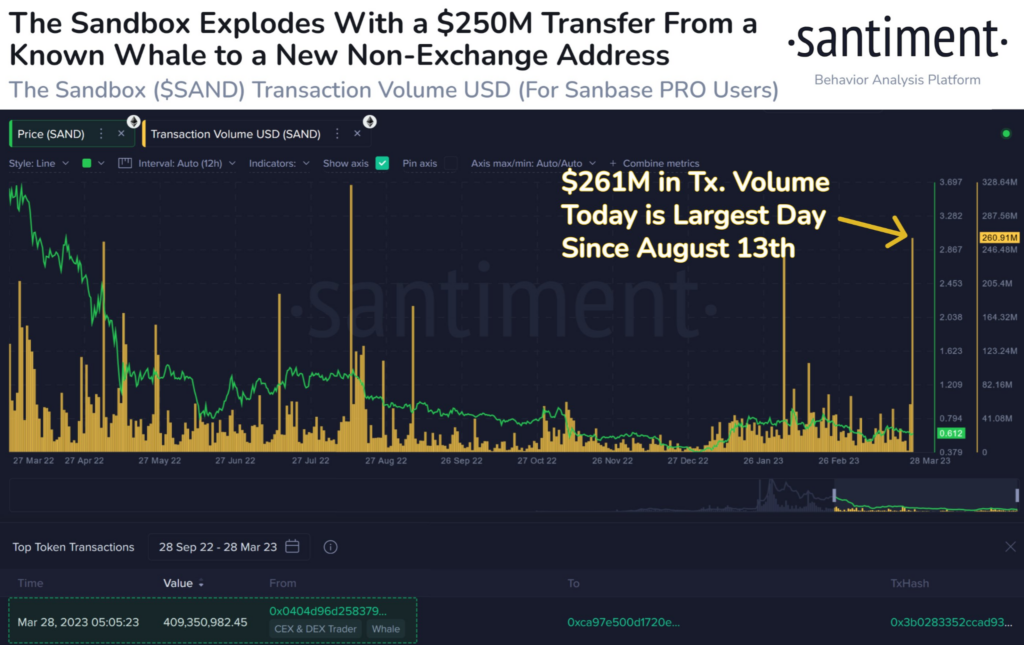

Santiment (@santimentfeed), a reputable blockchain analytics firm, has reported a significant transaction involving a prominent The Sandbox (SAND) whale. The tweet revealed that the whale had transferred a substantial amount of SAND, totaling 409 million units, valued at around $250 million. As per the tweet, the entire amount was moved to a new address earlier today.

According to Santiment’s recent tweet, the amount of SAND moved today marks a significant milestone, surpassing the volume of movement observed during the asset’s inaugural week in August 2020. The staggering $261 million moved today also represents the highest volume of movement witnessed in the past seven months. These statistics highlight the growing popularity and demand for SAND, indicating a promising future for the asset.

As of the time of publication, CoinMarketCap reports that SAND has experienced a 3.65% increase in price over the past 24 hours. The altcoin has demonstrated a 0.96% strength against Bitcoin (BTC). However, SAND was unable to maintain the same level of success against Ethereum (ETH), experiencing a 0.64% weaken during the same period. As a result, SAND’s current price stands at $0.6262.

The altcoin is presently hovering near its daily peak of $0.6312, while its 24-hour nadir is approximately $0.5927.

The value of SAND is striving to surpass the 9-day and 20-day EMA lines. If successful, this would propel the price of SAND towards the subsequent crucial resistance level, estimated to be approximately $0.6914.

A bullish flag is poised to activate as the daily RSI line approaches a potential cross above the RSI SMA line. This development could support SAND’s price to surpass the 9 and 20 EMA lines.

As the next 24 hours unfold, traders are advised to monitor the 9 and 20 EMA closely. A potential short-term bullish cycle for SAND’s price may be on the horizon if the shorter EMA surpasses the longer EMA. In such a scenario, the target price to aim for would be $0.7550. Stay vigilant and keep a watchful eye on these key indicators.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.