- Bitcoin falls over 5%, rebounds to $42,510 amid market instability.

- Cryptocurrency liquidations reach $411 million; Bitcoin, Ethereum face heavy losses.

- Bitcoin challenges $43,000 resistance, risks drop if level not surpassed.

The week began with instability in the cryptocurrency market, with leading digital currencies, Bitcoin

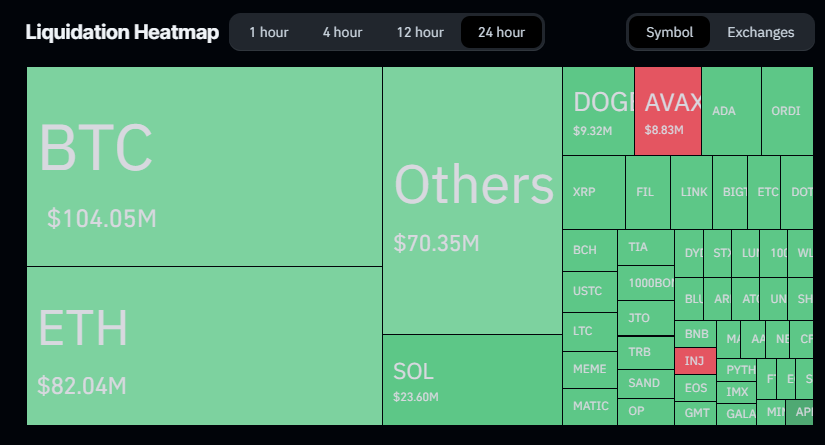

CoinGlass data showed that liquidations totaled $411 million in the last 24 hours, including $357 million from long positions in the wider cryptocurrency market. The liquidation heatmap indicated that Bitcoin and Ethereum saw liquidations of over $104 million and $82 million, respectively. Additionally, smaller alternative cryptocurrencies decreased in value due to the prevailing market turbulence.

Will Bitcoin’s Growth Trend Reemerge?

Despite the economic decline, Bitcoin has kept a positive outlook, surpassing the resistance level of $42,500. At present, BTC’s trading price is $42,182, and it has a daily trading volume of $24.7 billion, which signifies a rise of 54% in trading activity compared to the previous day.

Currently, BTC’s value is undergoing a rebound, facing significant resistance near the $42,600 mark. Should Bitcoin break through the $43,000 resistance level, it may trigger a surge in bullish activity, possibly resulting in a climb to $43,650. A firm end above this threshold could start a robust climb, aiming for the next key resistance point at $43,950 and possibly extending gains up to $44,500.

Nonetheless, if Bitcoin cannot surpass the resistance at $43,000, it may face a potential drop. The first level of support is expected to be approximately $41,800, with a subsequent support zone at $41,350. If it falls beneath this threshold, it might prompt an examination of the $40,000 area, indicating possible negative trends for the foremost digital currency.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.