- THORChain (RUNE) price drops to $5.44, a 0.80% decrease.

- RUNE’s market cap and 24-hour volume fell by 0.69% and 51.13%.

- RSI at 43.93 suggests increasing buying activity, hinting at potential price reversal.

Over the past day, the market for THORChain

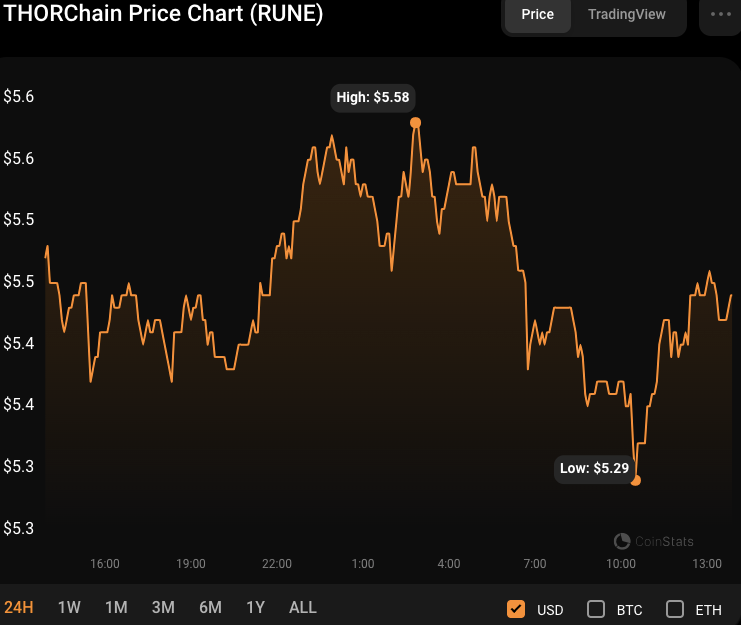

The declining trajectory of RUNE persisted, as the current trading price was $5.44, reflecting a 0.80% decrease from the day’s peak of $5.58, as reported by CoinStats. Should the price fall below the day’s minimum of $5.40, it could trigger further sell-offs, potentially driving the price down to the subsequent support mark at $5.20.

Nonetheless, should the bulls regain the intraday peak and drive the value beyond $5.58, this could indicate a potential shift away from the downward trend, with an expected subsequent resistance level around $5.80. Conversely, the market capitalization of RUNE and its 24-hour trading volume decreased by 0.69% and 51.13%, reaching $1,838,625,736 and $200,061,694, respectively.

The 3-hour price chart for RUNEUSD shows a downward trend in the Keltner Channel bands, with the upper band at $6.04515935, the middle band at $5.62821886, and the lower band at $5.23310402, all of which point to a strong bearish influence on the RUNE market. The decreasing trading volume also points to a reduced interest in buying within the market, reinforcing the bearish trajectory.

Conversely, bullish candlestick patterns on the chart indicate that the price action has recovered from the lower band and is currently displaying signs of a potential reversal. This pattern could suggest a shift in market sentiment and a chance for purchasers to enter the market.

Additionally, the Relative Strength Index (RSI), now at 43.93, has risen past the signal line, indicating a potential increase in buying activity. This shift in the RSI suggests that the buying force is gathering momentum, which could potentially push the price upward substantially. Should the RSI maintain its upward trajectory and surpass the 50 mark, it could signal stronger bullish activity and attract more buyers.

In summary, although THORChain (RUNE) is experiencing downward market forces, there are indications of a possible trend change, as evidenced by the Relative Strength Index (RSI) showing an increase in purchasing power.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.