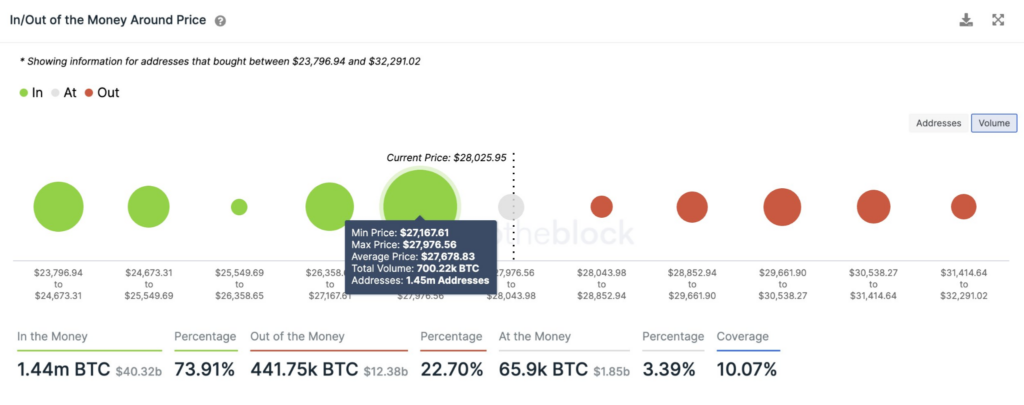

This morning, Ali (@ali_charts), a prominent crypto trader, shared a noteworthy observation on Twitter. He highlighted the presence of a substantial buy wall for Bitcoin (BTC), indicating a strong support level between $27,170 and $27,970. The tweet further revealed that over 1.45 million addresses had purchased more than 700,000 BTC within this price range. This information could prove valuable for investors seeking to make informed decisions in the volatile crypto market.

According to Ali’s analysis, the current buy wall presents a promising opportunity for BTC’s price to ascend. He further asserts that minimal obstacles hinder BTC’s potential to surge beyond its current level.

In the interim, the cryptocurrency trader known as Bluntz (@Bluntz_Capital) has expressed a less optimistic perspective on BTC in a recent tweet. Bluntz suggests that the bullish momentum for BTC is showing signs of diminishing and predicts that the cryptocurrency will likely seek to revisit the $26K threshold in the coming week.

According to the latest data from CoinMarketCap, the leading cryptocurrency has experienced a modest 0.97% increase in price over the past 24 hours. However, this gain has not been sufficient to reverse the downward trend of BTC’s weekly performance, which currently stands at a 0.65% decrease over the last seven days. As of now, the price of BTC is valued at $27,809.63.

Bitcoin’s market dominance has increased by 0.24% in the past 24 hours, bringing its crypto market share to 46.24%. The leading cryptocurrency’s market capitalization currently stands at an impressive $537,650,143,541, while the total estimated market cap for all cryptocurrencies is around $1.16 trillion. These figures demonstrate Bitcoin’s continued strength and influence in the crypto space.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.