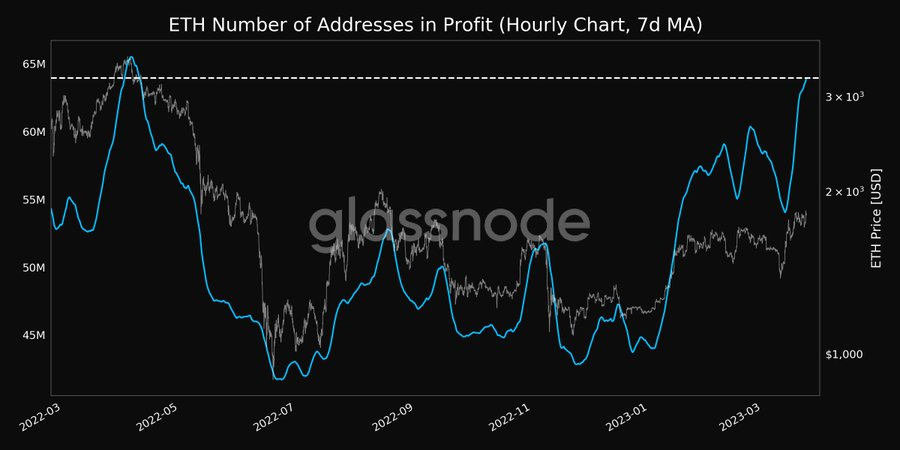

Renowned on-chain analysis firm, Glassnode recently shared fresh insights and metrics on Twitter regarding Ethereum (ETH), the largest altcoin by market cap. Per their post, the 7-day moving average of ETH’s profitable addresses has surged to a new 11-month high of 63,933,355.435. This development highlights the growing profitability of ETH and its increasing adoption among investors.

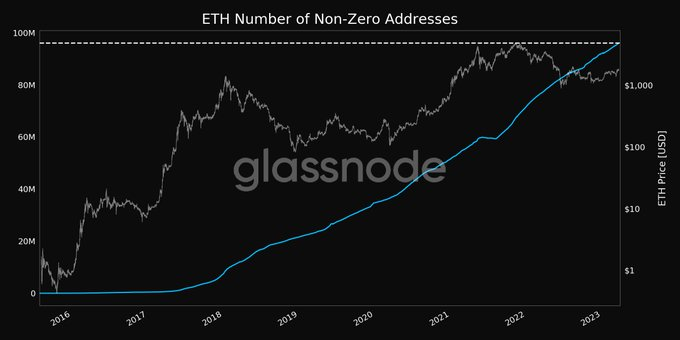

Glassnode, a leading blockchain analytics firm, has reported that Ethereum (ETH) has achieved a new all-time high (ATH) regarding non-zero addresses. As announced on Twitter this morning, the number has surged to an impressive 96,039,880. This milestone comes after the previous 11-month high of 63,912,252.762, recorded on March 23, 2023. These figures demonstrate ETH’s continued growth and adoption, cementing its position as a leading cryptocurrency in the market.

The crypto market experienced a somber Monday, but today’s outlook is already brighter, particularly for ETH. According to CoinMarketCap, ETH is presently exchanging at $1,813.93, reflecting a 3.43% surge in value over the past 24 hours. During this period, ETH also attained a high of $1,853.89 and a low of $1,746.58.

The altcoin has demonstrated its resilience by gaining a 1.32% advantage over its major rival, Bitcoin (BTC), in the past 24 hours. Furthermore, ETH’s weekly performance remains impressive, with a gain of over 4% in the last seven days. These results showcase the altcoin’s potential to hold its own in the highly competitive cryptocurrency market.

ETH’s 24-hour trading volume has dipped into the red zone, settling at $10,824,571,720, following a 14% decline from the previous day. Regarding market capitalization, ETH presently holds a value of $222,012,423,954.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.