- Bitcoin value establishes support level near $25,000, rebounds to $26,000.

- Ex-BitMEX CEO suggests Federal Reserve’s rate decrease could elevate BTC to $70,000.

- Digital asset market experiences decline with key indicators decreasing, reports Glassnode.

The Bitcoin

Arthur Hayes, the ex-CEO of BitMEX, recently proposed that a decrease in the Federal Reserve’s rate could elevate BTC to a $70,000 mark and rejuvenate the US financial system. This assertion introduces a fresh perspective into the ongoing dialogue among investors about the prospective trajectory of the cryptocurrency market.

Expecting High Market Instability

Blockchain data analytics company Glassnode reports that the digital asset market is experiencing a decline. Key indicators such as liquidity, volatility, and volume in the digital asset market are all decreasing. Furthermore, numerous metrics have returned to their levels before the bull market of 2020.

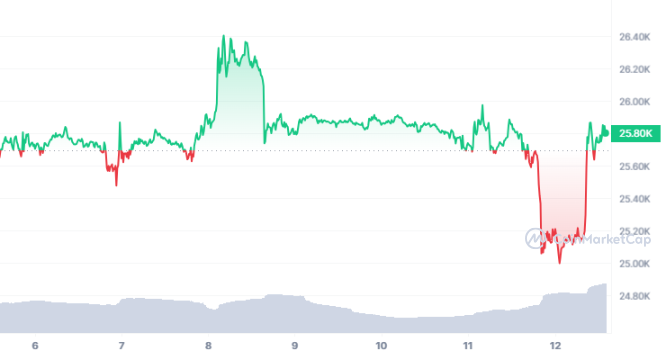

As per the latest data from CMC, Bitcoin is currently valued at $25,800, marking a 0.03% increase in the last 24 hours. Additionally, there has been a significant surge in trading volume, up by 111.92% in the same period. Should the price surpass the $26,380 threshold, we anticipate a new rally reaching $28,000.

Conversely, should the bears drive the price below the $25,000 mark, we could see a drop to as low as $20,130. Market participants, including investors and traders, eagerly anticipate the forthcoming release of U.S CPI and PPI data this week, which will likely influence their subsequent actions.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.