- The U.S. Court of Appeals has ordered the SEC to reassess Grayscale Investments’ proposal for a Bitcoin ETF.

- Bitcoin’s price increased by over 7.5% following the court’s decision.

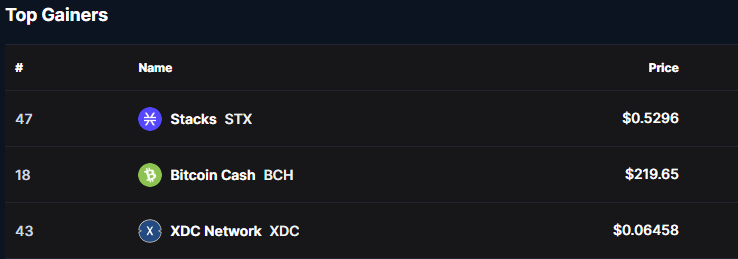

- Altcoins Stacks, Bitcoin Cash, and XDC Network saw significant price increases.

On Tuesday, the U.S. Court of Appeals mandated that the Securities and Exchange Commission (SEC) reassess the proposal submitted by Grayscale Investments, a leading digital asset management firm, to initiate the inaugural Bitcoin Exchange-Traded Fund (ETF).

This decision hinders SEC Chairman Gary Gensler’s efforts to oversee the rapidly expanding cryptocurrency industry. In immediate reaction to this event, Bitcoin, the globe’s most substantial cryptocurrency, witnessed a notable price increase of more than 7.5%, escalating from $25,968 to $27,983.

The bullish trend sparked by Bitcoin’s price trajectory has significantly propelled the worldwide cryptocurrency market, with numerous prominent altcoins showcasing appreciable growth. Specifically, three altcoins – Stacks (STX), Bitcoin Cash (BCH), and XDC Network (XDC) – distinguished themselves as the day’s most significant gainers.

The value of Stacks (STX) has surged by 18%

Stacks

A significant technical detail to note is that the price of Stacks has surged beyond its 50-day exponential moving average (EMA), highlighting its bullish trend. Furthermore, the Relative Strength Index (RSI) for STX is nearing neutral territory, indicating a stable market sentiment.

Bitcoin Cash (BCH) sees a 15% rise in its rally

In a noteworthy development, Bitcoin Cash

The robust performance of BCH underscores the escalating interest and assurance among investors in this alternative cryptocurrency.

XDC Network (XDC) Maintains Upward Trend

The XDC Network

To sum up, these advancements underscore the volatile and swift-moving characteristics of the cryptocurrency market. Here, regulatory verdicts and market mood can trigger swift fluctuations in asset worth.