- ThorChain (RUNE) surged 46.71% in a week, outpacing Dogecoin and Shiba Inu.

- RUNE’s surge signifies a three-month peak, last attained in May.

- The Relative Strength Index indicates RUNE is in an overbought condition.

Most altcoins have remained relatively stagnant in the past week, showing no substantial movement. However, ThorChain

RUNE’s recent surge positions it as the leading gainer among the top 100 assets and signifies a three-month peak, a level it last attained in May.

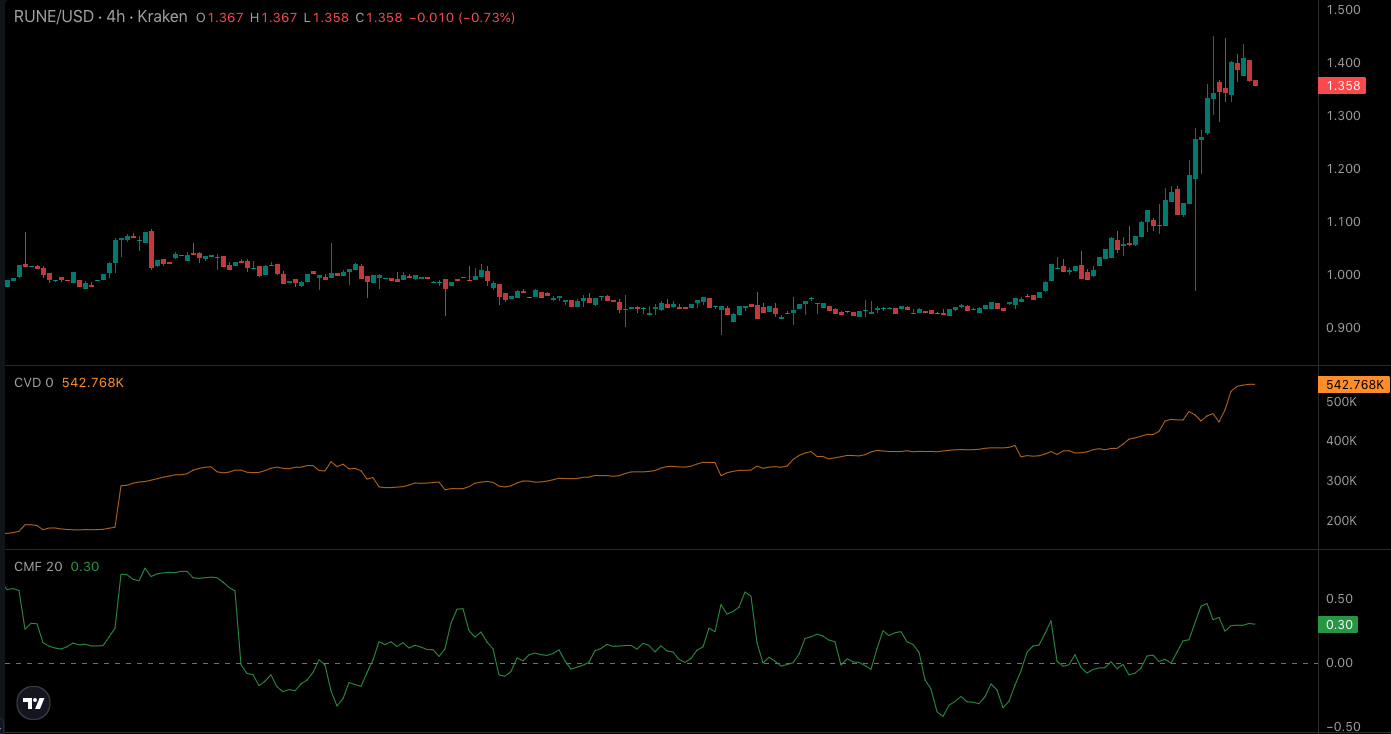

The impressive surge has sparked inquiries regarding the potential of ThorChain’s native token to maintain its prominence in the future. Per the 4-hour RUNE/USD chart, the token has successfully surpassed numerous resistance levels, converting them into support and establishing a bullish market configuration.

Correction is on its Way

Following its climb to a high of $1.41, RUNE underwent a correction to $1.36, suggesting that traders had begun to realize their gains. Nevertheless, the Exponential Moving Average (EMA) suggests that this minor setback may not be significant enough to disrupt the prevailing bullish momentum.

As of the latest update, the 20-day Exponential Moving Average (EMA), represented in blue, has intersected with the 50-day EMA, depicted in yellow. This crossover may be attributed to the surge in demand observed at the $0.93 mark on August 7. Consequently, the overall market sentiment for RUNE continues to lean towards the bullish side.

Considering the Relative Strength Index (RSI), it has ascended, reaching a peak of 73.14. This RSI value indicates that RUNE is in an overbought condition. Consequently, there’s a possibility that RUNE might trend downward if the buying momentum doesn’t surpass profit realization. Should the demand diminish, RUNE’s price correction could drop to as low as $0.85.

The capital keeps pouring into RUNE

Furthermore, the Cumulative Volume Delta (CVD) bolstered a bullish outlook. As of the latest update, the CVD had escalated to 542,787. The CVD provides a valuable perspective on market dynamics as a gauge to assess an asset’s medium to long-term buying and selling pressure.

Should the CVD trajectory take a downward turn, it signifies a dominance of aggressive sellers in the market. However, the recent surge in RUNE’s CVD suggests a significantly higher presence of buyers than sellers. Additionally, the Chaikin Money Flow (CMF) registered a value of 0.30.

The Chaikin Money Flow (CMF) effectively tracks distribution and accumulation by leveraging a blend of recent price fluctuations and trading volume. Consequently, a surge in the CMF corresponds with the Cumulative Volume Delta (CVD) concept, indicating a rise in buying pressure.

Should the upward momentum in purchasing activity persist, RUNE can escalate to a peak of $1.50. However, a reversal in the current bearish trend indicated by the Relative Strength Index (RSI) is necessary to validate this potential surge.

Disclaimer: The insights, perspectives, and data presented in this price analysis are published in good faith. Readers must conduct their own research due diligence. Any decision made by the reader is solely their responsibility, and Crypto Outlooks shall not be held responsible for any consequential or incidental harm or loss.